How Did Anil Ambani's Vast Wealth Disappear? A Closer Look

It's a story that, quite frankly, seems almost too dramatic to be true, yet it played out right before our eyes. We're talking about the incredible financial journey of Anil Ambani, a man who once stood shoulder-to-shoulder with the wealthiest individuals on the planet. For many, his name was synonymous with immense success, a true titan of Indian industry. Then, rather unexpectedly, the narrative shifted dramatically. People began to wonder, rather a lot actually, how did Ambani lose his wealth? It's a question that brings up so many other thoughts about business, family, and the sheer unpredictability of fortune.

This isn't just a tale about money vanishing; it's a look at the forces that can reshape even the most powerful financial empires. It explores how ambition, market shifts, and a string of significant decisions can lead to an outcome few could have imagined. His story, in a way, offers a really stark reminder that even the highest peaks of wealth can be quite slippery, so it's a bit of a cautionary tale, you know?

We'll explore the key moments, the strategic choices, and the external pressures that contributed to this remarkable downturn. It's a complex picture, certainly, involving various business sectors and some very high-stakes gambles. You'll get a pretty clear idea of the path that led from immense prosperity to, well, a very different financial reality, which is quite something to consider, isn't it?

Table of Contents

- Anil Ambani: A Brief Biography

- The Great Family Divide and Its Aftermath

- The Telecom Tangle: Reliance Communications' Downfall

- Debt: A Heavy Burden

- Unsuccessful Ventures and Poor Investment Choices

- Regulatory Hurdles and Policy Shifts

- Fierce Competition in Key Sectors

- The Impact of Global Economic Slowdowns

- Legal Battles and Personal Guarantees

- The Current Financial Picture

- Frequently Asked Questions (FAQ)

- Lessons From a Financial Fall

Anil Ambani: A Brief Biography

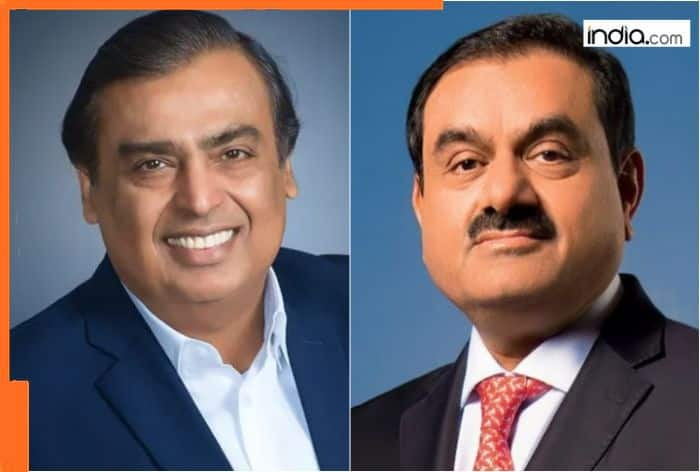

Anil Dhirubhai Ambani, born on June 4, 1959, is the younger son of the legendary Indian business magnate Dhirubhai Ambani, who founded Reliance Industries. He played a very significant role, you know, in the growth of the Reliance empire alongside his elder brother, Mukesh. After their father's passing, the brothers, rather famously, divided the vast business conglomerate, with Anil taking control of what became the Reliance Anil Dhirubhai Ambani Group (ADAG).

He was once counted among the world's richest people, with his net worth reaching billions of dollars. His business interests spanned various sectors, including telecommunications, financial services, infrastructure, power, and media. He was, in a way, seen as a very dynamic leader, often appearing in the media and engaging with public life. His journey, however, took a very different turn over the last decade or so, which is what many people are quite curious about, as a matter of fact.

| Full Name | Anil Dhirubhai Ambani |

| Date of Birth | June 4, 1959 |

| Place of Birth | Mumbai, Maharashtra, India |

| Father | Dhirubhai Ambani |

| Mother | Kokilaben Ambani |

| Brother | Mukesh Ambani |

| Spouse | Tina Munim Ambani |

| Children | Jai Anmol Ambani, Jai Anshul Ambani |

| Alma Mater | University of Mumbai, University of Pennsylvania (Wharton School) |

| Former Position | Chairman, Reliance Anil Dhirubhai Ambani Group (ADAG) |

The Great Family Divide and Its Aftermath

The story of Anil Ambani's financial challenges often begins with the split of the Reliance empire between the two brothers, Anil and Mukesh, back in 2005. This division, brokered by their mother, Kokilaben, was meant to bring peace after a period of public disagreements. Anil received the newer, growth-oriented businesses, including telecommunications, power, and financial services, while Mukesh retained the traditional oil and petrochemicals businesses. It seemed like a fair division at the time, but, you know, the future held some very different paths for each part of the family business.

In some respects, this separation meant that Anil had to build his own empire from the ground up, so to speak, without the massive, steady cash flows that the older, more established businesses provided. He took on a lot of debt to fund his ambitious expansion plans, particularly in the telecom and power sectors. This initial financial structuring, more or less, laid some of the groundwork for the challenges that would come later, as a matter of fact. It was a very different kind of business environment he was stepping into.

The Telecom Tangle: Reliance Communications' Downfall

Perhaps the most significant factor in Anil Ambani's wealth decline was the spectacular collapse of Reliance Communications (RCom). RCom was once a major player in India's booming telecom market, yet it faced increasing pressure from intense competition and, you know, some very rapid technological shifts. The company struggled with mounting debt and a declining subscriber base. It's almost as if the market changed too quickly for it to keep up, which can happen, certainly.

The entry of Reliance Jio, Mukesh Ambani's telecom venture, in 2016, proved to be a particularly devastating blow. Jio offered incredibly cheap data and voice services, completely disrupting the market. RCom, already burdened by debt and older infrastructure, found it incredibly difficult to compete. It was, in a way, a perfect storm of challenges that really hit hard. The company eventually filed for bankruptcy, leaving behind a massive pile of debt and essentially wiping out a huge portion of Anil Ambani's personal wealth that was tied to it.

Debt: A Heavy Burden

Across many of his ventures, especially RCom and Reliance Power, Anil Ambani's companies accumulated very significant amounts of debt. This was largely to fund ambitious expansion projects and, well, to acquire assets. Borrowing money is a common business practice, of course, but when revenues don't grow as expected or when projects face delays, that debt can become an unbearable weight. It's like, you know, trying to carry too much at once, and eventually, something has to give.

The interest payments alone became a huge drain on the companies' finances, making it very difficult to invest in new technologies or to compete effectively. Lenders, naturally, became increasingly concerned, leading to pressure for repayment and, in some cases, asset sales. This cycle of debt, apparently, just kept growing, making it harder and harder to recover. It was a really tough situation for the businesses to be in, so it seems.

Unsuccessful Ventures and Poor Investment Choices

Beyond telecom, some of Anil Ambani's other business ventures also struggled to deliver expected returns. Reliance Power, for instance, faced delays in project execution and issues with fuel supply, which really hampered its profitability. There were, in a way, a few other investments that just didn't pan out as hoped, perhaps due to market conditions or, you know, just not being the right fit at the right time. It's a bit like placing bets that don't quite come through, which can be very costly.

Sometimes, the timing of these investments was also a factor. Launching into certain sectors at the peak of a boom, or, conversely, just before a downturn, can make a huge difference. These choices, in some respects, contributed to a broader weakening of his overall business portfolio. It wasn't just one thing, but rather a combination of factors, that really added up over time, you see.

Regulatory Hurdles and Policy Shifts

The Indian business landscape, as a matter of fact, can be quite complex, with frequent changes in regulations and government policies. Anil Ambani's businesses, particularly in the telecom and power sectors, were very susceptible to these shifts. For example, policy changes related to spectrum allocation or environmental clearances could significantly impact project timelines and costs. It's almost like the rules of the game kept changing, which can be incredibly frustrating for any business trying to plan for the long term.

These regulatory hurdles, sometimes, caused delays that led to cost overruns and lost opportunities. They could also make it harder to raise fresh capital or to attract new partners. In a way, the external environment played a significant role in creating additional challenges for his companies, which were already facing quite a bit of pressure, you know?

Fierce Competition in Key Sectors

The sectors Anil Ambani chose to operate in—telecom, power, and financial services—are notoriously competitive in India. He faced very strong rivals, some of whom had deeper pockets or more established market positions. For instance, in telecom, besides Jio, companies like Airtel and Vodafone Idea were also battling for market share. It was, quite frankly, a really tough fight for survival.

This intense competition often led to price wars and reduced profit margins. Companies had to spend huge amounts on marketing and network upgrades just to keep up. For businesses already struggling with debt, this kind of environment made it incredibly difficult to achieve profitability and, therefore, to service their loans. It's a bit like running a race where everyone else is sprinting, and you're already carrying extra weight, which is quite a challenge, isn't it?

The Impact of Global Economic Slowdowns

While many of the factors were internal or specific to India, global economic conditions also played a part. Periods of economic slowdown or uncertainty can affect investor confidence, making it harder for companies to raise funds or to sell assets. If the global economy isn't doing so well, you know, it can create ripples that affect even very large businesses. This means, quite simply, that even if you're doing things right, external forces can still make things incredibly difficult.

For businesses like Anil Ambani's, which were heavily reliant on debt and capital-intensive projects, a tighter credit market or a dip in investor sentiment could have a very significant impact. It's like, you know, when the tide goes out, you can see who's been swimming without trunks, so to speak. These broader economic trends, in some respects, just added another layer of difficulty to an already challenging situation, apparently.

Legal Battles and Personal Guarantees

As his companies faced increasing financial distress, Anil Ambani found himself embroiled in a series of legal disputes with lenders and creditors. Many of these cases involved significant sums of money, and some even led to personal guarantees he had provided for his companies' loans. This meant that if the companies couldn't pay, he, personally, would be held responsible. It's a very serious commitment, and it can have profound personal consequences, as we've seen.

One very high-profile case involved a dispute with Ericsson, a Swedish telecom equipment maker, over unpaid dues. The Supreme Court of India even threatened him with a jail term if the payment wasn't made, and his brother, Mukesh Ambani, stepped in at the last minute to help with the payment. This particular event, you know, really highlighted the extent of his financial difficulties and the personal stakes involved. These legal battles were, quite frankly, a huge distraction and a massive drain on resources, which only made things harder.

The Current Financial Picture

By early 2020, Anil Ambani declared before a UK court that his net worth was "zero" and that he was bankrupt. This was a truly astonishing statement for someone who had once been among the world's richest individuals. While this declaration related to a specific legal context, it underscored the dramatic reversal of his fortunes. His various companies are now largely in the hands of lenders or undergoing insolvency proceedings. It's a very different landscape from what it was, just a little while ago.

His remaining assets are minimal compared to his former wealth, and he faces ongoing challenges related to past debts and legal obligations. The empire he built, in a way, has largely crumbled, which is a really stark reminder of how quickly things can change in the business world. It's a pretty clear example of how, sometimes, even the biggest players can face insurmountable odds, which is quite a thought, isn't it?

Frequently Asked Questions (FAQ)

1. Is Mukesh Ambani also facing financial difficulties?

No, not at all. Mukesh Ambani, Anil's elder brother, continues to be one of the wealthiest people globally. His businesses, particularly Reliance Industries and Reliance Jio, have seen tremendous growth and success, quite unlike Anil's ventures. They operate very separately now, you know, with very different outcomes.

2. What was the main reason for Anil Ambani's wealth loss?

The primary reason was the massive debt accumulated by his companies, especially Reliance Communications (RCom), coupled with intense competition in the telecom sector, particularly after the entry of Reliance Jio. Unsuccessful investments and regulatory challenges also played a very significant part, as a matter of fact. It was a combination of many things, really.

3. Did the family split contribute to his financial decline?

In some respects, yes. The split meant Anil had to build his own financial strength without the established cash flows of the older Reliance businesses. This led him to take on considerable debt for expansion, which became a major issue when market conditions turned unfavorable. It set him on a very different path, apparently, which proved to be quite challenging.

Lessons From a Financial Fall

The story of Anil Ambani's financial decline offers some truly powerful lessons for anyone interested in business or, you know, just about life in general. It shows how critical it is to manage debt very carefully, even when you're incredibly ambitious. Taking on too much leverage, it turns out, can make a business very vulnerable to market shifts and unexpected competition. It's like building a very tall tower on a shaky foundation, so to speak.

It also highlights the importance of adapting quickly to changing market conditions. The telecom sector, in particular, saw very rapid disruption, and companies that couldn't keep pace often struggled. For businesses, this means, quite literally, being nimble and ready to change direction, which is not always easy. The story, in a way, is a stark reminder that even the most powerful figures can face incredibly tough times, and that the path to success is, very often, not a straight line. Learn more about business resilience on our site, and for more insights into market dynamics, link to this page understanding market shifts.

For further reading on the broader context of corporate debt and its implications, you might find this article on corporate debt challenges quite informative. It's a very complex topic, and, you know, there are many layers to it, so it's worth exploring in depth.

Mukesh Ambani lost thousands of Crores from his net worth in 24 Hours; Know the amount, his

Mukesh Ambani remains India's richest man despite losing Rs 100000000000, Gautam Adani's wealth

How Anil Ambani lost his wealth worth billions of rupees #ambani #indianbillionaire #anilambani