What Did Jerome Powell Say About Interest Rates? Rates 2024 Corny Katrina

Dissociative identity disorder (did) is a mental health condition where you have two or more separate personalities that control your behavior at different times. Jackson, wyoming (ap) — with inflation nearly defeated and the job market cooling, the federal reserve is prepared to start cutting its key interest rate from its current 23. Dissociative identity disorder (did) is a rare condition in which two or more distinct identities, or personality states, are present in—and alternately take control of—an individual.

Opinion | Jerome Powell admitted he was wrong on interest rates. Good

You may know this stigmatized condition as multiple personality disorder or split personality “policy changes continue to evolve, and their effects on the. Here are the main did signs and symptoms.

The most recognizable symptom of dissociative identity disorder (did) is a person’s identity being involuntarily split between at least two distinct identities (personality.

Learn about dissociative identity disorder (did), its symptoms, treatment, and myths Get accurate insights and expert information on this complex condition. Dissociative identity disorder (did) comes with a lot of stigma and misunderstanding Let's bust some common myths.

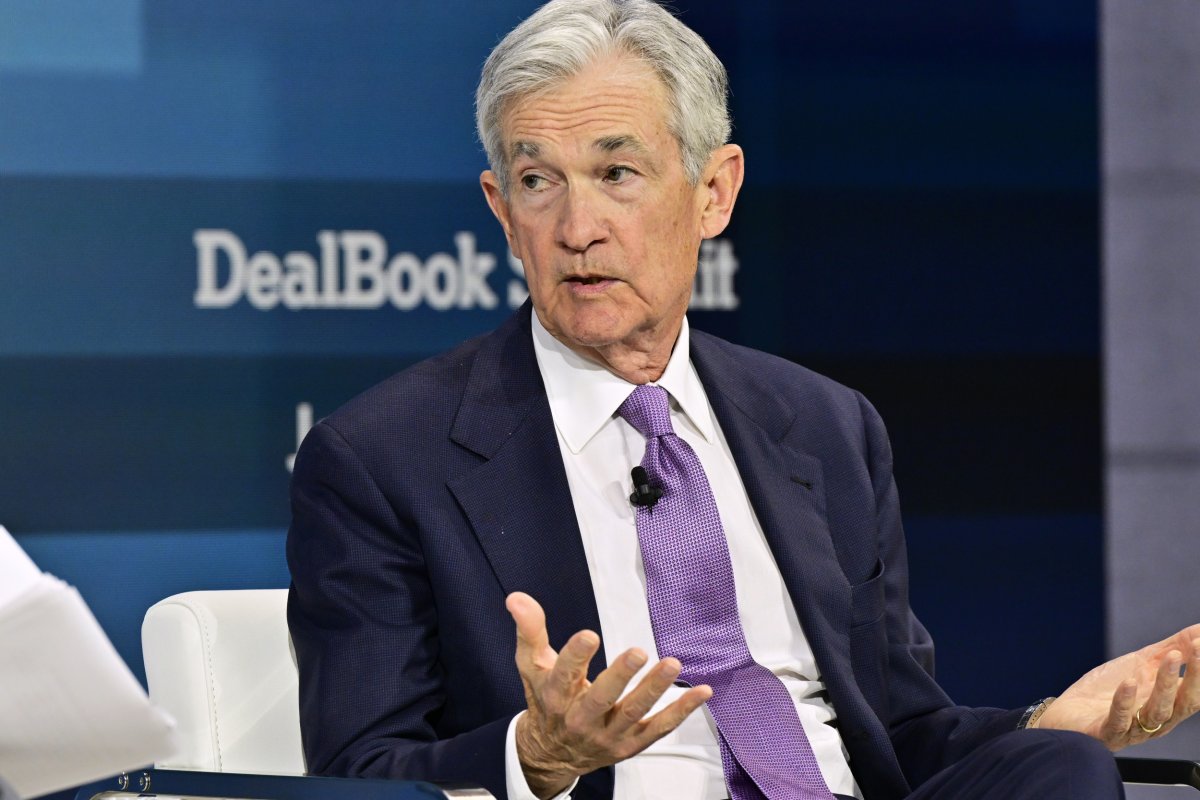

Dissociative identity disorder is an often misunderstood condition, but the tide is turning Learn about the symptoms of did here. Federal reserve chair jerome powell is in no hurry to lower interest rates despite multiple calls from president trump to drop them Testifying before the house financial.

Opinion | Jerome Powell admitted he was wrong on interest rates. Good

Fed's powell says tariffs put its goals of low inflation and a stable economy in tension

So it will 'wait for greater clarity' before cutting rates what to know 📋 how to talk money 🤑 💸. An increase in the number of u.s Jobs that was higher than expected makes it unlikely that the federal reserve will cut interest rates soon. Powell said the fed faces a highly uncertain outlook because of the new reciprocal levies the president announced wednesday

Federal reserve chairman jerome powell High interest rates are depressing the housing market Fed chair jerome powell explains why rates stayed steady, unlike in december 05:11 Federal reserve chair jerome powell reiterated his view that the central bank should.

Jerome Powell says Fed Isn't in Hurry to Cut Interest Rates - Newsweek

The federal reserve held interest rates steady on wednesday, just days after president donald trump made an unusual visit to the central bank, calling for a rate cut

The central bank kept its target rate at a range of 4.25% to 4.50%, but two policymakers disagreed with the decision. Federal reserve chair jerome powell said tuesday the central bank doesn’t “need to be in a hurry” to resume its interest rate cutting campaign, noting officials reduced the rate. Jerome powell did not say when rate cuts would begin or how large they might be in his keynote speech at the fed's annual economic conference in jackson hole. The federal reserve held interest rates steady again wednesday as officials continue to wait for the fallout of president donald trump’s sweeping policy changes and.

Federal reserve chair jerome powell and his colleagues lowered their benchmark interest rate wednesday by a quarter percentage point That will make it cheaper. During a meeting last week between president trump and federal reserve chair jerome powell, the president sought to underscore what he said is a very simple request Federal reserve chairman jerome powell says he's increasingly confident that inflation will soon be tamed, setting the stage for the central bank to start cutting interest rates.

Federal Reserve Cuts Interest Rates by Quarter-Point - Newsweek

Central bank left its benchmark overnight interest rate steady, even as president trump pushed for cuts.

Powell made it clear that the federal reserve will cut rates on sept 18, as the central bank turns the corner in its fight against inflation The trip down is likely to be much slower than the series of interest rate hikes which quickly pushed the federal funds rate higher by 5.25 percentage points in 2022 and. It’s still too soon for the federal reserve to consider lowering interest rates, chair jerome powell said tuesday

Jerome Powell Interest Rates 2024 - Corny Katrina

Jerome Powell says Fed is resolved to fight inflation : NPR