Who Pays The Fed Interest Rate? A Look At How Money Moves Today

Have you ever wondered about the Federal Reserve and its interest rates? It's a topic that often comes up in the news, yet what it really means for your wallet can feel a bit hazy. Many people ask, "Who pays the Fed interest rate?" and it's a great question, because the answer isn't as simple as you might think, you know.

The Federal Reserve, often just called "the Fed," is the central bank of the United States. It plays a very big role in our economy. Its decisions about interest rates can touch nearly every part of your financial life, from the cost of your home loan to what you earn on your savings account. It's a system with many connections, so.

Today, April 23, 2024, we'll break down this important idea. We will look at who actually pays interest to the Fed, and perhaps more importantly, how the Fed's rate decisions affect everyone else. We will see how money moves through the financial world because of these rates, and how it impacts you, more or less.

Table of Contents

- Understanding the Federal Reserve's Role

- The Federal Funds Rate: A Key Rate

- Who Pays the Fed Directly?

- The Ripple Effect: How Rates Touch Everyone

- Banks and Borrowers: The Main Channels

- You and Your Wallet: Feeling the Impact

- The Ultimate Payer: A Deeper Look

- Frequently Asked Questions

- Bringing It All Together

Understanding the Federal Reserve's Role

The Federal Reserve is not like a bank where you keep your checking account or get a car loan. It's a special kind of bank, a central bank. Its main job is to keep the country's economy healthy. This means aiming for stable prices, which helps control how much things cost. It also means trying to have lots of jobs for people, you know.

The Fed does this through what is called monetary policy. This involves using different tools to influence how much money and credit are available in the economy. One of its most talked-about tools is setting interest rates. This is a very powerful way to guide economic activity, so.

It's important to see the Fed as a public body, not a private business looking to make money for itself. Its goal is to serve the public good. So, any money it earns usually goes back to the U.S. Treasury, which is a bit different from how regular companies work, naturally.

The Federal Funds Rate: A Key Rate

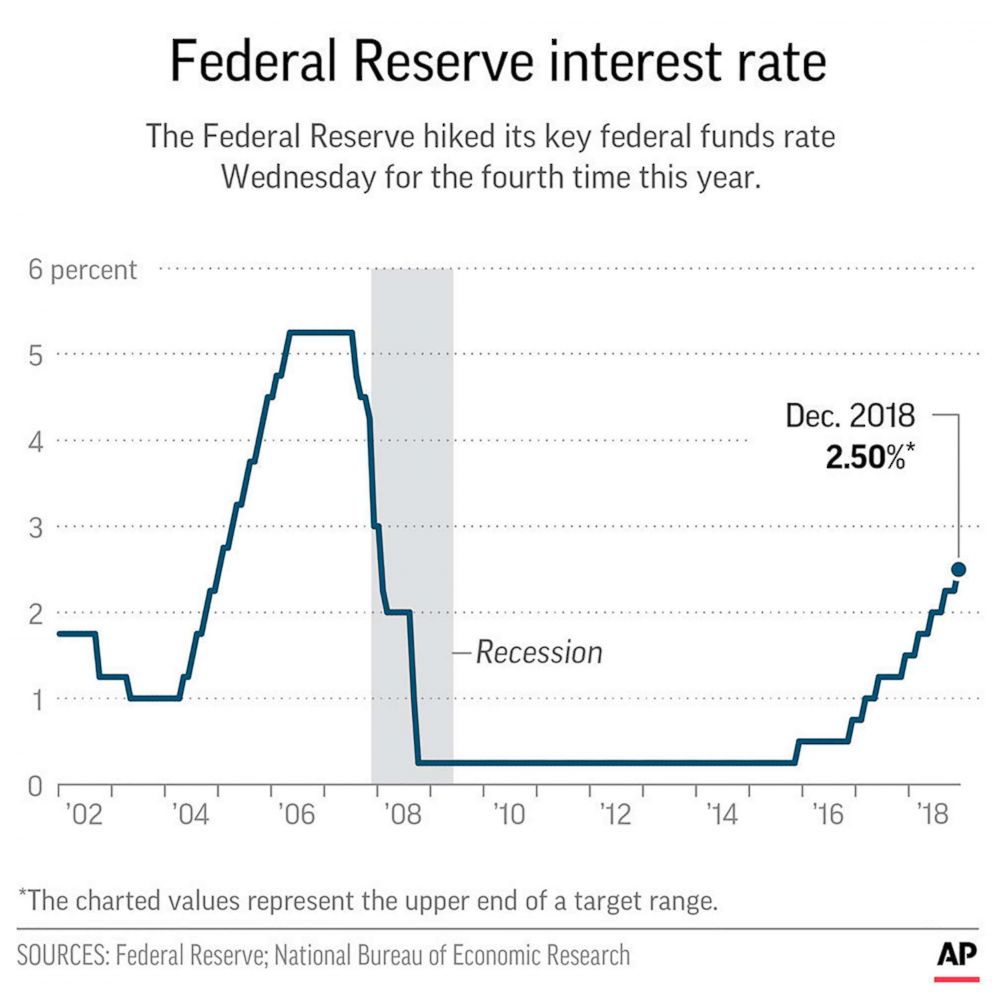

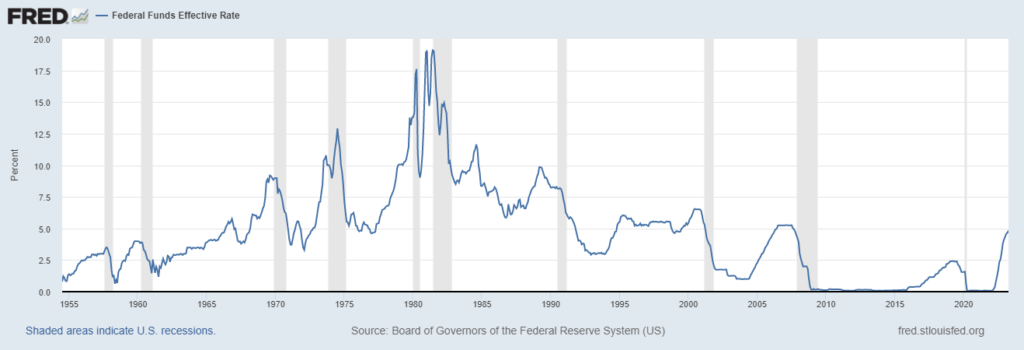

When we talk about "the Fed interest rate," we are usually talking about the federal funds rate. This is a target rate, not a single rate that everyone pays. It's the rate that banks charge each other for overnight loans. Banks often lend money to one another to make sure they have enough cash on hand, you see.

The Fed sets a target for this rate. It does not directly tell banks what to charge. Instead, it uses other tools to encourage banks to lend to each other at or near that target rate. This target rate then becomes a very important benchmark for many other rates in the economy, actually.

Think of it as a foundational rate. It's like the starting point for all other interest rates. When this rate moves, other rates tend to follow. This is how the Fed's decisions spread throughout the entire financial system, more or less.

Who Pays the Fed Directly?

This is where the idea of "who pays the Fed interest rate" gets interesting, as a matter of fact. The average person or small business does not send interest payments directly to the Federal Reserve. You don't get a bill from the Fed for your mortgage interest or credit card debt. That money goes to your bank or lender.

The main entities that deal directly with the Fed on interest rates are banks. When banks borrow from each other overnight, they pay interest at a rate influenced by the Fed's target. This is the federal funds rate we just talked about. It's a cost of doing business for banks, you know.

Also, the Fed pays interest to banks on the money they keep at the Fed. This money is called "reserves." By paying interest on these reserves, the Fed can influence how much money banks are willing to lend out. So, in some respects, the Fed can also be a payer of interest, not just a receiver. This is a very important tool for managing the money supply, so.

When the Fed sells government bonds, it takes money out of the banking system. When it buys bonds, it puts money in. The interest on these bonds is paid by the U.S. Treasury, which is part of the government, not directly by individual citizens to the Fed. It's a subtle but important difference, you see.

So, while the Fed does earn interest on the government securities it holds, and banks pay interest when they borrow from each other at the federal funds rate, this isn't the same as you paying interest directly to the Fed. The flow of money is more indirect, pretty much.

The Ripple Effect: How Rates Touch Everyone

Even if you don't pay the Fed directly, its interest rate decisions spread through the whole economy. They are very much like ripples in a pond after you drop a stone. When the Fed changes its target rate, it sends a powerful signal. This signal affects what banks charge each other for money. It also affects what banks charge their customers for loans.

Think of it this way: if banks have to pay more to borrow money themselves, they will naturally ask for more when they lend it out to you. This means the cost of borrowing for homes, cars, and businesses changes. It's a chain reaction that moves through the financial system, basically.

This is where the old saying, "he who pays the piper calls the tune," comes into play. The Fed, by setting this key rate, influences the tune that everyone else in the financial world plays. They don't directly collect interest from millions of people. But their actions set the stage for who pays what, and how much it costs to get money, more or less.

When rates go up, borrowing money becomes more expensive. This can slow down spending and investment. When rates go down, borrowing becomes cheaper, which can encourage more spending and economic activity. This broad effect is how the Fed's influence is felt far and

What is the Federal Reserve and how do interest rates affect me? - ABC News

Fed Interest Rates History, Statistics, and Charts

Why the Fed Raised Interest Rates - The New York Times