What Is The Net Worth Of The Geo Group? Understanding Corporate Financials

Many people, you know, are curious about the financial health of big companies, and the Geo Group is certainly one that draws attention. When we talk about "net worth" for a business, we're really looking at a picture of its financial standing at a specific moment. It helps us see, in a way, what the company would have left if it sold everything it owned and paid off all its debts. For a company like the Geo Group, which operates in a rather specific industry, understanding its financial foundation is pretty important for various reasons, whether you're an investor, a researcher, or just someone interested in how these large organizations manage their money. So, figuring out this number is, as a matter of fact, about more than just a single figure; it's about seeing the bigger financial story.

It's worth pointing out, however, that finding a precise, current "net worth" figure for any large, publicly traded company like the Geo Group requires looking at their official financial reports. These numbers change quite often, you see, as assets and liabilities shift. The information I have available to me, which you provided as "My text," discusses updates for the .NET framework, like the April 22, 2025 update for Windows 11 and the June 10, 2025 refresh for .NET 8.0, as well as security improvements for older versions. This text, quite frankly, does not contain any details about the Geo Group's financial standing or its net worth. Therefore, I cannot use "My text" as a source for the specific financial figures you're asking about.

Instead, to get a real sense of what the Geo Group's financial situation looks like, we need to consider how companies report their financial information publicly. This involves looking at things like their balance sheets, which are basically snapshots of their assets and liabilities. Knowing where to find this information, and how to make sense of it, is really the key to answering the question about their net worth. It's not just about getting a number; it's about understanding what that number represents and where it comes from, too it's almost a process of financial investigation.

Table of Contents

- What Does "Net Worth" Mean for a Company?

- Why People Ask About the Geo Group's Financial Standing

- How Public Companies Like Geo Group Report Their Financials

- Finding the Geo Group's Net Worth: Where to Look

- Understanding the Fluctuations in Company Net Worth

- Distinguishing Net Worth from Market Capitalization

- Frequently Asked Questions About The Geo Group's Financials

What Does "Net Worth" Mean for a Company?

For a company, net worth is essentially the total value of its assets minus its total liabilities. This is also often called "shareholders' equity" or "owner's equity" on a balance sheet. Think of it like this: if a business were to sell off all its properties, equipment, and other things it owns (its assets), and then use that money to pay back all its loans and bills (its liabilities), what's left over is its net worth. It's a key indicator of a company's financial strength, you know, showing how much value the owners or shareholders truly have in the business. A positive net worth means the company's assets are more than its debts, which is generally a good sign. Conversely, a negative net worth suggests the company owes more than it owns, which can be a bit concerning.

Assets can include many different things, for instance, cash, buildings, land, vehicles, and even things like patents or trademarks. Liabilities, on the other hand, cover things like bank loans, accounts payable (money owed to suppliers), and other financial obligations. The calculation is, quite simply, Assets - Liabilities = Net Worth. This figure is, in some respects, a foundational piece of information for anyone trying to understand a company's financial standing. It gives you a pretty clear picture of the company's financial foundation, or lack thereof, at a given time. This snapshot is, you know, just one piece of the puzzle, but a very important one.

Why People Ask About the Geo Group's Financial Standing

People often ask about the net worth of a company like the Geo Group for a few important reasons. Investors, for example, look at net worth to judge a company's financial stability and its potential for future growth. A strong net worth can suggest a company is well-managed and has the resources to handle economic ups and downs. They want to know if their money would be, you know, safe and if there's a chance for a good return. Also, analysts and financial experts use this information to evaluate a company's overall health and compare it to others in the same industry. This helps them make recommendations or predictions about the company's future performance. It's all about making informed decisions, really.

Beyond the financial community, the public and various advocacy groups might also be interested in the Geo Group's net worth. As a company involved in correctional and detention facilities, its operations often draw public scrutiny. Understanding its financial size and stability can provide insights into its capacity to operate, its long-term viability, and its influence within its sector. It's a way, you know, for people to assess the scale of the company's operations and its overall economic footprint. So, the interest in this number is, quite frankly, pretty broad, going beyond just those looking to invest. It helps people understand the company's position, in a way, within the larger economic picture.

How Public Companies Like Geo Group Report Their Financials

Publicly traded companies, like the Geo Group, are required to share their financial information with the public and with regulatory bodies. In the United States, this means filing regular reports with the Securities and Exchange Commission (SEC). These filings are, for instance, the most reliable source of financial data for any public company. They provide a detailed look at the company's revenues, expenses, assets, and liabilities. The SEC filings are designed to ensure transparency, allowing investors and the public to get a clear picture of a company's financial situation. It's how everyone gets, you know, the same information, which is pretty important for fair markets.

The Balance Sheet: A Snapshot

The balance sheet is the primary financial statement where you'll find the components needed to calculate a company's net worth. It's called a "balance sheet" because it always balances: Assets must equal Liabilities plus Shareholders' Equity (Net Worth). This document provides a snapshot of the company's financial position at a specific point in time, like the end of a quarter or a fiscal year. It's not, you know, a moving picture, but a still one. Assets are listed on one side, showing what the company owns, while liabilities and equity are on the other, showing where the money to acquire those assets came from. For example, assets could be cash, accounts receivable (money owed to the company), inventory, property, and equipment. Liabilities might include accounts payable (money the company owes), short-term loans, and long-term debt. Shareholder equity, then, represents the owners' claim on the assets after all debts are paid. It's a pretty clear way, you know, to see the company's financial structure.

Beyond the Numbers: Other Factors

While the balance sheet gives a clear picture of net worth, other factors also influence a company's financial health and perception. For a company like the Geo Group, its contracts with government entities are, naturally, a big part of its business model. Changes in government policy or public sentiment regarding private correctional facilities can, in a way, affect future revenue and, by extension, its financial outlook. Legal challenges or regulatory changes can also have a significant impact on operations and profitability. These external elements, you know, are not directly on the balance sheet but they certainly shape the company's financial trajectory. So, looking at the net worth is just one piece of the puzzle; you also have to consider the environment the company operates within, which is, you know, a pretty big deal.

Finding the Geo Group's Net Worth: Where to Look

To find the most accurate and up-to-date information on the Geo Group's net worth, you really need to go straight to the source. Publicly traded companies are, by law, required to disclose their financial information. This means the data is available for anyone to look at, which is, you know, pretty helpful. You won't find this kind of detail in general news articles, but rather in specific financial documents. Knowing where to look is, in some respects, half the battle when you're trying to understand a company's financial standing. It's about finding the official records, which are, frankly, the most reliable. Learn more about financial reporting on our site.

Official Company Reports

The best place to find the Geo Group's net worth is in their official financial reports filed with the SEC. Specifically, you'd look for their Form 10-K, which is their annual report, and their Form 10-Q, which are their quarterly reports. These documents contain their balance sheets, income statements, and cash flow statements. On the balance sheet, you'll find the "Total Shareholders' Equity" figure, which is the company's net worth. These reports are, you know, updated regularly, so checking the latest filing will give you the most current information. They are, in fact, the gold standard for financial data, providing a complete and verified picture of the company's financial state. You can usually find these reports on the Geo Group's investor relations website or directly through the SEC's EDGAR database. This is, basically, where the official numbers live.

Financial News Outlets and Databases

While official reports are the primary source, many reputable financial news outlets and online databases compile this information for easier access. Websites like Yahoo Finance, Bloomberg, or Reuters often provide summaries of a company's financials, including equity figures. These platforms pull data directly from the SEC filings, so they can be a convenient way to get a quick overview. However, it's always a good idea to cross-reference with the official SEC documents for the most complete and detailed information, especially if you're making important decisions. They are, in a way, secondary sources, but very useful ones for quick checks. It's like your, you know, daily financial newspaper, but online. You can also link to this page for more insights into corporate finance.

Understanding the Fluctuations in Company Net Worth

It's important to remember that a company's net worth is not a fixed number; it changes over time. Just like your own personal finances, a company's financial picture is, you know, always moving. This figure can go up or down based on a variety of factors, both internal to the company and external market forces. For instance, a company might increase its net worth by making a profit and retaining those earnings, or by issuing new stock. Conversely, losses, paying out large dividends, or taking on more debt without a corresponding increase in assets can decrease net worth. It's a rather dynamic figure, reflecting the ongoing operations and decisions of the business. So, looking at a single number without context is, frankly, not enough.

Market Conditions and Industry Trends

Broader economic conditions and trends within the specific industry can significantly influence a company's net worth. For example, a strong economy might lead to more opportunities for contracts and higher revenues, which could boost a company's assets and profitability. On the other hand, an economic downturn or shifts in industry regulations could negatively affect a company's operations and, consequently, its financial standing. The private corrections industry, for instance, is subject to political and social debates, which can create uncertainty and affect long-term prospects. These external forces are, in some respects, beyond a company's direct control but have a very real impact on its financial health. It's like, you know, the weather affecting a farmer's crops; some things are just bigger than one company.

Operational Performance and Strategic Moves

A company's own operational performance and strategic decisions also play a big role in its net worth. Efficient management, successful new projects, or expanding into profitable areas can lead to increased assets and earnings. For example, if the Geo Group secures new, large contracts and manages them effectively, its revenue and asset base could grow, positively affecting its net worth. Conversely, operational inefficiencies, costly legal battles, or poor investment decisions could reduce its assets or increase its liabilities, thereby lowering its net worth. Strategic moves, such as acquiring other companies or divesting certain assets, can also significantly alter the balance sheet. These are, you know, the things the company itself does that shape its financial destiny. It's all about how well they play their cards, basically.

Distinguishing Net Worth from Market Capitalization

When people talk about a company's financial size, two terms often come up: net worth and market capitalization. While both are important, they measure different things. We've already discussed net worth, which is based on the balance sheet: Assets minus Liabilities. It's a book value, reflecting what the company owns and owes. Market capitalization, however, is calculated by multiplying the company's current share price by the total number of its outstanding shares. This figure represents the total value of the company as perceived by the stock market. So, it's, you know, what investors think the company is worth right now. For example, if a company has 100 million shares and each share is priced at $10, its market capitalization would be $1 billion.

The key difference is that net worth is an accounting measure, rooted in historical costs and financial statements, while market capitalization is a market measure, reflecting current investor sentiment and future expectations. Market capitalization can fluctuate much more dramatically than net worth because it's directly tied to daily stock price movements. A company with a relatively low net worth might have a very high market capitalization if investors believe it has strong future growth potential. Conversely, a company with a high net worth might have a lower market capitalization if investors are pessimistic about its future. They are, in a way, two different lenses through which to view a company's value. It's like, you know, looking at a house's construction cost versus what someone is willing to pay for it today. Both are important, but they tell different stories.

Frequently Asked Questions About The Geo Group's Financials

People often have specific questions about the Geo Group's money matters. Here are some common ones, with general answers that point you toward understanding the financial landscape of such a company:

How does the Geo Group make its money?

The Geo Group primarily generates revenue through contracts with government agencies, including federal, state, and local entities, for the management and operation of correctional and detention facilities. They also provide related services, such as transportation and electronic monitoring. These contracts are, basically, their main source of income. They are, you know, paid for providing these services, which is how their business model works. It's a service-based business, really, with government as the main client.

What are the biggest expenses for the Geo Group?

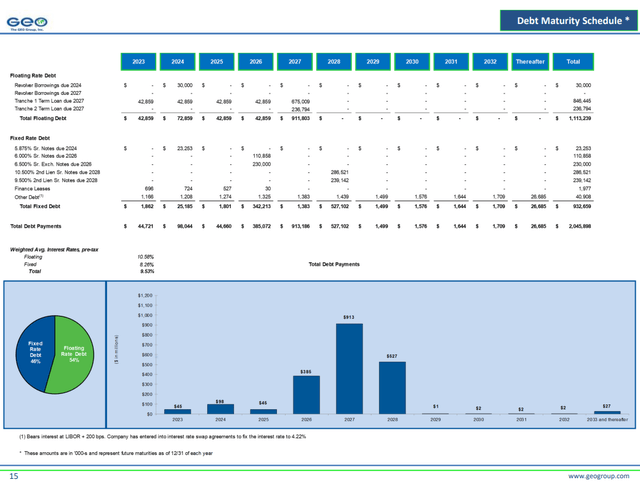

For a company like the Geo Group, significant expenses typically include personnel costs (salaries, benefits for staff), facility maintenance and operations, security equipment, and utilities. Debt service (interest payments on loans) can also be a considerable expense, given the capital-intensive nature of building and maintaining facilities

The GEO Group: A More Sustainable Model Than The Market Is Pricing In (NYSE:GEO) | Seeking Alpha

George Zoley Net Worth, Biography, and Insider Trading

Bank of New York Mellon Corp Sells 106,367 Shares of The GEO Group, Inc. (NYSE:GEO)