How Much Does It Cost To Attend Elon University? A Look At The Real Numbers

Thinking about college is a big step, and for many, figuring out the money part can feel like a really big puzzle. You might be wondering, "How much does it cost to attend Elon University?" This question is, you know, super common for families and students alike, and it's a very smart thing to ask early on. Knowing the financial picture helps you plan things out, and that's pretty important for your future education.

Getting a good grasp on college costs means looking beyond just the sticker price. There are, you know, several pieces to the financial puzzle when you think about attending a place like Elon. It's not just tuition; there are also fees, a place to live, food, books, and even money for personal things. Understanding all these parts can help you see the whole picture, which is actually a lot clearer than you might first think.

We're going to break down what you can expect to pay for a year at Elon University, giving you a really good idea of the different expenses involved. This way, you can get a better sense of what your family might need to budget. It's all about getting clear information so you can make the best choices, and that's what we're here to help you with, basically.

Table of Contents

- Understanding the Price Tag at Elon

- Sticker Price Versus Your Actual Cost

- Ways to Get Financial Help for Elon

- Smart Tips for Making Elon More Affordable

- Your Questions Answered

- Making Your College Dream a Reality

Understanding the Price Tag at Elon

When you look at the cost of any college, it's pretty helpful to break it down into different parts. Elon University, like many private schools, has several components that make up the total yearly expense. We're going to look at these pieces one by one, giving you a clearer picture of what to expect for a recent academic year, like the 2023-2024 period. This is, you know, just a general guide, and specific numbers can change a little each year, so it's always good to check their official site for the most current figures.

Tuition and Required Fees: The Main Part

The biggest chunk of your college bill will, you know, usually be the tuition. This is the amount you pay for your classes and for being a student at the university. For a recent academic year, Elon's tuition has been in the range of about $43,000 to $45,000. That's a pretty significant amount, but it covers the core academic experience you're getting.

Beyond tuition, there are also required fees. These fees cover things like using the campus health services, being able to participate in student activities, and keeping the technology running across the school. These often add a few thousand dollars to the overall cost, perhaps somewhere around $1,500 to $2,000. So, really, when you add the tuition and these fees together, you're looking at a base cost for just being enrolled and taking classes, which is something to consider right away.

Housing and Meals: Where You Live and Eat

For most students, especially those in their first year, living on campus is a pretty big part of the college experience. The cost for a place to live, like a dorm room, can vary quite a bit depending on the type of room you choose. Some rooms are single, some are doubles, and some might even be suites with multiple students sharing a common area. This expense, you know, usually includes utilities like electricity and internet, which is nice.

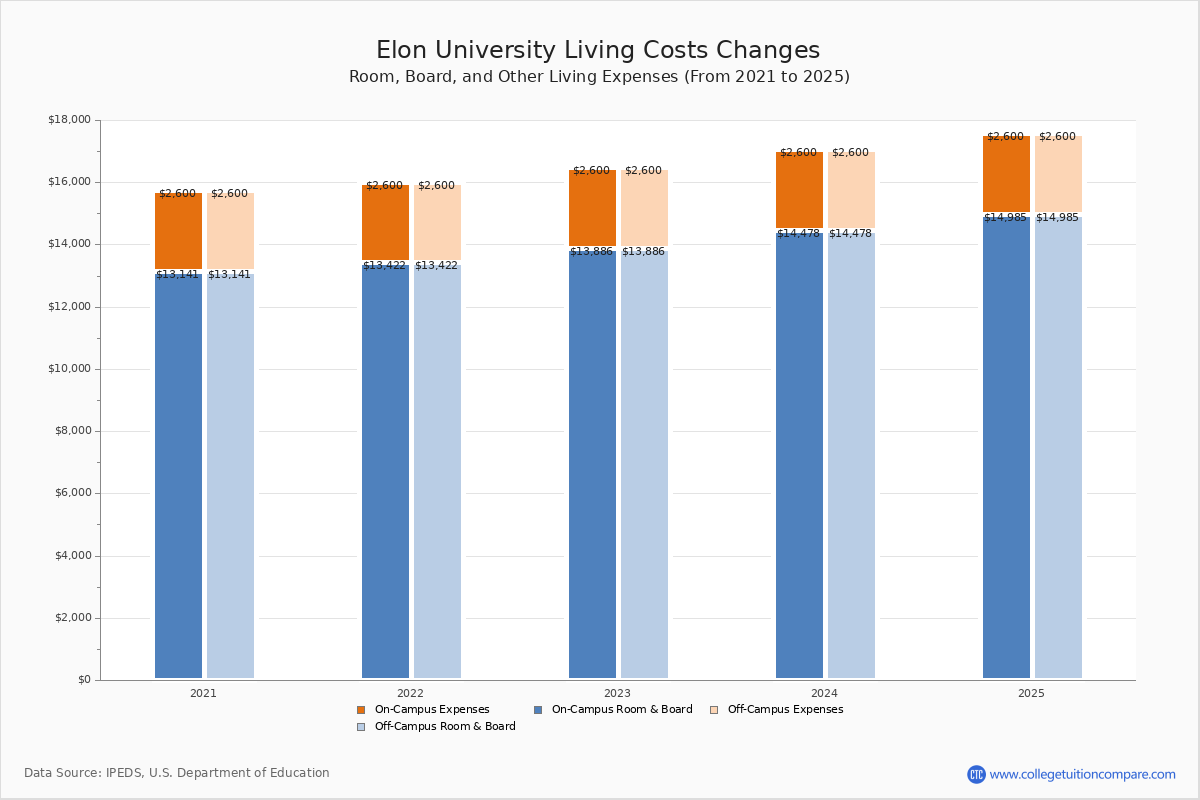

Meal plans are another big part of living on campus. Elon, like many universities, offers different meal plan options that let you eat at various dining halls and cafes around campus. The cost of housing and a typical meal plan for a year can, you know, often add up to somewhere in the range of $14,000 to $16,000. This amount covers your living space and your food, which are pretty essential things, as a matter of fact.

Books and Supplies: What You Need to Learn

You can't really go to college without needing some books and other learning materials, can you? This category covers everything from textbooks for your classes to notebooks, pens, and even special software or equipment for certain subjects. The cost here can vary a lot depending on your major and the specific courses you're taking each semester. For example, an art student might need more supplies than someone studying history, so it's good to keep that in mind.

Generally, colleges estimate that students will spend somewhere around $1,000 to $1,200 a year on books and supplies. You can sometimes save money here by buying used books, renting them, or finding digital versions, which is actually a smart move. So, while it's not the biggest expense, it's definitely something to budget for, you know, pretty much every year.

Personal Expenses and Transportation: The Little Extras

Beyond the main costs, there are always personal expenses that pop up. This includes things like laundry, toiletries, going out with friends, getting snacks, or maybe even buying new clothes. These are the costs that are, you know, very much up to your own spending habits, so they can differ quite a bit from one person to another. It's important to set a realistic budget for these kinds of things so you don't run out of money too soon.

Transportation costs also need to be thought about, especially if you're not from the immediate area. This could mean money for flights home during breaks, gas money if you have a car on campus, or even public transport fares if you're exploring the local area. For personal expenses and transportation combined, a typical estimate might be around $2,000 to $3,000 a year. It's a pretty good idea to factor this in, as these small amounts can really add up, you know.

Sticker Price Versus Your Actual Cost

When you add up all those numbers – tuition, fees, housing, meals, books, and personal stuff – you get what's called the "sticker price" or the "cost of attendance." For Elon University, this total can be somewhere around $60,000 to $65,000 for a single academic year. That number can seem, you know, really big, and it's totally understandable if it feels a bit overwhelming at first glance.

However, it's really important to remember that very few students actually pay the full sticker price. Most students receive some kind of financial help, which lowers their "net price." The net price is the amount you actually pay after scholarships and grants are taken away from the sticker price. This is, you know, the number that truly matters for your family's budget. So, while the sticker price gives you a starting point, it's not the whole story, not by a long shot.

Ways to Get Financial Help for Elon

Finding ways to pay for college is a big part of the application process. Luckily, there are many options available to help make Elon University more affordable. These options fall into a few main categories, and it's a really good idea to explore all of them to see what you might qualify for. Basically, the more help you can get, the less you'll have to pay out of your own pocket, which is pretty obvious, you know.

Scholarships and Grants: Money You Don't Pay Back

This is, arguably, the best kind of financial help because it's money you don't have to pay back. Scholarships are often awarded based on things like your academic achievements, your talents (like in sports or music), your community involvement, or even your specific background. Elon University offers its own institutional scholarships, and there are also countless scholarships available from outside organizations. You know, a bit of research here can really pay off.

Grants are typically given based on financial need, meaning they're for students whose families show they have a harder time paying for college. The federal government offers Pell Grants, and states also have their own grant programs. Elon itself offers grants based on need, too. Applying for these usually involves filling out the Free Application for Federal Student Aid (FAFSA), which is, you know, a very important step for almost everyone seeking financial help. Learn more about financial aid options on our site, and link to this page here.

Loans: Money You Do Pay Back

Loans are another common way to pay for college, but it's important to remember that this is money you will need to repay, usually with interest, after you graduate or leave school. There are federal student loans, which often have better terms and interest rates than private loans. Federal loans can be subsidized, meaning the government pays the interest while you're in school, or unsubsidized, where interest starts adding up right away. So, you know, it's worth understanding the difference.

Private loans come from banks or other financial institutions. These often require a credit check and might have higher interest rates. It's generally a good idea to borrow only what you absolutely need and to prioritize scholarships and grants first. Taking on too much loan debt can, you know, really affect your financial future after college, so be careful about that, actually.

Work-Study: Earning While You Learn

Work-study is a federal program that allows students to earn money to help pay for educational expenses through part-time jobs, usually on campus. If you qualify for work-study, you'll be offered a certain amount you can earn during the academic year. These jobs are often flexible and designed to fit around your class schedule, which is pretty convenient. You know, it's a way to gain some work experience while also chipping away at your costs.

These jobs can range from working in the library or a campus office to helping out in a lab or even tutoring other students. The money you earn through work-study goes directly to you, and you can use it for whatever you need, whether it's books, personal expenses, or even to help cover a portion of your tuition. It's a pretty good option for many students, honestly.

Smart Tips for Making Elon More Affordable

Even with the financial aid options, the cost of college can still feel like a lot. But there are some practical steps you can take to try and lower your overall expenses or manage them better. These tips can, you know, really make a difference in your college budget.

- Apply for as many scholarships as you can: Don't just rely on the ones from Elon. Look for local scholarships, national ones, and those tied to your interests or background. Every bit of free money helps, seriously.

- Fill out the FAFSA early: The Free Application for Federal Student Aid is, you know, really important for getting federal and institutional aid. The earlier you submit it, the better your chances of getting certain types of aid, as some funds are given out on a first-come, first-served basis.

- Consider a budget: Once you know your expected costs, create a personal budget for your spending. Track where your money goes so you can see if you're spending too much on non-essentials. This is, you know, pretty much a basic financial skill.

- Look for cheaper books: Instead of buying brand new textbooks, try renting them, buying used copies, or looking for digital versions. Sometimes, you can even find older editions that are much cheaper and still perfectly fine for your class.

- Think about part-time work: If you don't qualify for work-study, or if you need more income, consider a part-time job off-campus. Just be sure it doesn't, you know, affect your studies too much.

- Explore payment plans: Elon, like many schools, might offer monthly payment plans that let you spread out the cost over the semester or year instead of paying a big lump sum all at once. This can make it easier to manage cash flow, you know, pretty much.

- Live smart: If you're able to choose your housing, sometimes a less expensive dorm option can save you a good amount of money. Also, being mindful of your meal plan choices can help. You know, sometimes a smaller plan is enough if you don't eat every meal in the dining hall.

Your Questions Answered

We know you probably have some specific questions on your mind about Elon's costs, and that's totally understandable. Let's tackle a few common ones that people often ask, because, you know, getting clear answers can really help.

Is Elon University expensive?

Compared to public universities, Elon University's sticker price is, you know, pretty much higher. As a private institution, its tuition and fees are set without state funding, which means they tend to be higher than what you'd see at a state school. However, it's really important to remember that the sticker price isn't what most students actually pay. Elon is known for offering a good amount of financial aid, including merit-based scholarships and need-based grants, which can bring the actual cost down for many families. So, while the initial number looks big, the actual cost can be much less, you know, depending on your situation.

How much does the average student get in financial help at Elon?

The amount of financial help a student gets at Elon can, you know, vary a lot. It really depends on a few things: your family's financial situation, your academic achievements, and any special talents you might have. For a recent year, a significant percentage of Elon students received some form of financial aid. Many students receive a combination of scholarships and grants, which means money they don't have to pay back. The average amount of institutional aid (aid from Elon itself) can be quite substantial, often bringing the total cost down by a good amount. It's worth looking at the net price calculators on college websites, as they can give you a personalized estimate, which is pretty helpful, you know.

What are some ways to make Elon more affordable?

There are several really practical ways to make attending Elon more manageable financially. First, applying for financial aid by completing the FAFSA and any other required forms from Elon is, you know, absolutely essential. Second, actively search for and apply to as many outside scholarships as you can. These can come from local community groups, national organizations, or even specific companies. Third, consider working part-time, either through a work-study program if you qualify or by finding a job off-campus. Also, being smart about your daily spending, like budgeting for personal expenses and looking for cheaper textbooks, can add up to real savings. Basically, every little bit helps, and being proactive is, you know, key.

Making Your College Dream a Reality

Figuring out "How much does it cost to attend Elon University?" is a really important step in your college planning. It's clear that the total price tag includes more than just tuition, covering everything from where you sleep to what you eat and the books you need. While the sticker price might seem high, remember that financial aid, like scholarships and grants, can make a very big difference in what you actually pay. Many students find that with careful planning and by seeking out all available help, Elon can be a reachable goal.

Taking the time to understand all the costs and exploring every avenue for financial support is, you know, pretty much the best way to approach this. Don't let the initial numbers scare you away. Instead, use this information to create a solid plan. Reach out to Elon's financial aid office with any specific questions you have, as they are there to help you figure things out. They can give you personalized advice and help you understand your options, which is, you know, a very valuable resource.

Elon University Tuition & Fees

Elon University Costs& Find Out the Net Price

Elon University - Tuition & Fees, Net Price