How Much Does H&R Block Charge To Do Taxes Online? A Clear Look

Thinking about doing your taxes online this year? You are probably wondering, perhaps very much so, about the costs involved. It is a common question, and a good one, especially when you are considering a big name like H&R Block. Knowing what you might pay upfront can make a real difference in how you approach your tax preparation, couldn't it?

There are a lot of choices out there for filing your tax paperwork, and H&R Block offers a few different ways to get it done right from your own computer. It is almost like picking the right tool for a specific job; you want something that fits your situation without costing more than it should. So, figuring out the price structure is a smart first step, isn't it?

This article will walk you through the various options H&R Block provides for online tax filing, giving you a better idea of what each one includes and, more importantly, what they typically cost. We will look at the different service levels and any extra fees that might come up, helping you get a clear picture of your potential expenses for the tax season, which, as of late 2023, is just around the corner for many.

Table of Contents

- Understanding H&R Block Online Options

- What Affects the Cost?

- Choosing the Right H&R Block Online Package

- Frequently Asked Questions About H&R Block Online Charges

Understanding H&R Block Online Options

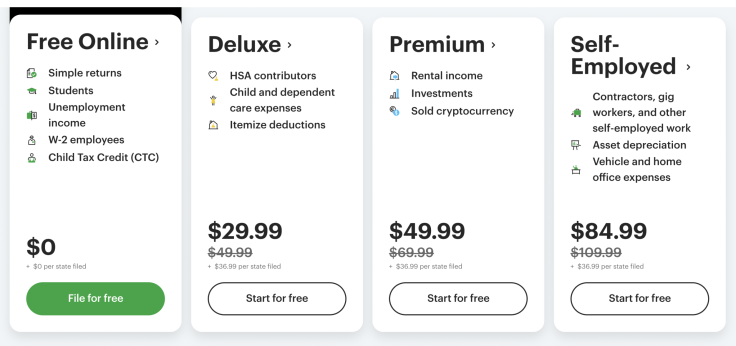

H&R Block offers a range of online tax filing products, each designed for different tax situations. It is a bit like choosing a car; some are basic, some have more features, and some are built for specific purposes. Knowing which one suits your needs can save you money and headaches, don't you think? Each option has a base price for federal filing, and then, typically, a separate charge for state returns.

The Free Online Version

Yes, H&R Block does offer a free online filing option. This is a pretty good deal for folks with simpler tax situations. If your income comes mostly from W-2 forms, you are taking the standard deduction, or you have things like unemployment income or student loan interest, this version could be a fit. It is designed for those who do not have a lot of different income sources or deductions to claim. So, if your taxes are fairly straightforward, this could be your path, and it won't cost you a penny for the federal return, which is nice, isn't it?

Deluxe Online: A Step Up

For those whose tax life is a bit more involved, the Deluxe online product is often the next step. This version is usually a good choice if you own a home and want to itemize your deductions, or if you have health savings accounts (HSAs). It provides more forms and guidance for these common situations. The price for Deluxe is, of course, higher than the free version, but it opens up more possibilities for tax savings if you have those particular items to report. It is a popular choice for many homeowners, as a matter of fact, looking for a bit more help.

Premium Online: For Investors and Rentals

If you are someone who has investments, perhaps stocks, bonds, or mutual funds, or if you own rental properties, the Premium online option is generally what you will need. This package handles more complex investment income and expenses related to rental properties. It is built to help you report gains and losses accurately from your investments, and to sort out the income and deductions from any rental units you might have. This level comes with a higher price tag, naturally, because it handles more intricate financial details, offering more specialized support for these kinds of earnings.

Self-Employed Online: For Business Owners

For small business owners, freelancers, or anyone with income from contract work (like a 1099-NEC), the Self-Employed online product is the one to look at. This version is specifically designed to help you report business income and expenses, figure out self-employment taxes, and even claim deductions for things like home office costs or business mileage. It is a rather robust option for those who work for themselves, and it is priced to reflect the added tools and forms needed for business tax situations. This is typically the most comprehensive, and thus the most expensive, online offering from H&R Block, as you might expect, considering all it covers.

What Affects the Cost?

While the base price for each online product gives you a general idea, there are a few other things that can influence the total amount you will pay. It is not just about the federal return, you see. Understanding these potential additions can help you avoid any surprises when you are ready to file, which is always a good thing, isn't it?

State Tax Filing

Almost every state that has an income tax will require you to file a state return in addition to your federal one. H&R Block typically charges a separate fee for each state return you need to file. This means if you live in one state but earned income in another, you might need to file multiple state returns, and each one will add to your total cost. So, when you are figuring out your budget, remember to account for those state fees, as they can sometimes be a bit of a surprise if you do not expect them.

Add-On Services

Beyond the core filing products, H&R Block offers various add-on services that can increase your overall charge. These might include things like audit protection, which gives you assistance if the IRS questions your return, or expert review services, where a tax professional looks over your completed return before you send it in. While these services can provide extra peace of mind or help, they do come with their own separate fees. It is worth thinking about if you need these extras, or if the basic package is enough for your needs, you know?

When we talk about "how much" these services cost, it really gets into the "great quantity" of features or the "degree" of assistance you are getting. The word "much" here speaks to the extent of the service, doesn't it? It is not just a simple number; it is about the value and breadth of what's included for that amount. So, if you are looking for a far larger amount of support, you will naturally expect the cost to reflect that added degree of help.

Choosing the Right H&R Block Online Package

Picking the right H&R Block online product really comes down to your personal tax situation. There is no one-size-fits-all answer, you know? Start by thinking about your income sources. Do you just have a W-2, or do you have freelance income, investments, or rental properties? Your deductions are also key. Are you taking the standard deduction, or do you have a lot of itemized deductions to claim, like mortgage interest or medical expenses? These questions will help guide you to the appropriate tier.

It is often a good idea to start with the free version and see how far you can get. The H&R Block software will usually prompt you if you need to upgrade to a higher-priced product based on the information you enter. This can save you from paying for features you do not actually need. Always be sure to review the features included in each package carefully before you commit. This way, you can be pretty sure you are getting the right level of support for your money, and not paying for something that is not much use to you.

Consider, too, the level of comfort you have with doing your own taxes. If you are very confident and your situation is simple, the free option might be all you need. If you feel a bit unsure, or your taxes are more complex, paying for a Deluxe or Premium version, or even adding an expert review, could be worth the extra charge for the peace of mind. It is about balancing cost with your personal need for guidance and support, isn't it? You can learn more about online tax preparation on our site, which might help you decide.

Keep in mind that prices can change, sometimes slightly, from one tax season to the next. The best way to get the most current pricing for H&R Block's online products is to visit their official website directly. They usually list all their pricing clearly there, and you can see any special offers that might be available at the time. This ensures you are getting the most up-to-date information for your filing, which is very important for financial decisions. You can often find current details right on their main page, which is a pretty good place to start, as a matter of fact.

When you are looking at the price, think about the value. Is the amount you are paying going to save you time, reduce stress, or potentially help you find more deductions? Sometimes, paying a bit more for a comprehensive service can actually lead to greater savings or fewer worries in the long run. It is not just about the number on the screen, but what that number represents in terms of support and features. For instance, if you get too much sleep, you may sleep through your alarm, but with taxes, too much help might just mean a smoother process, which is a different kind of "much" altogether, isn't it?

Remember, the goal is to get your taxes filed accurately and efficiently without spending more than you need to. By understanding the different H&R Block online options and what affects their pricing, you are better equipped to make a good choice for your tax season this year. It is about being informed, and that is a pretty powerful thing, really. You can also link to this page for more information on common tax questions that might pop up.

Frequently Asked Questions About H&R Block Online Charges

Is H&R Block free for everyone?

No, H&R Block is not free for everyone. They do offer a free online filing option, but it is generally for simpler tax situations. If you have more complex income, deductions, or investments, you will likely need to use one of their paid online products, which have different price points. So, it really depends on what your tax picture looks like, doesn't it?

Do I have to pay for state taxes with H&R Block online?

Yes, typically you will have to pay a separate fee for state tax filing when using H&R Block's online services. While the federal return might be free or part of a package, state returns usually come with their own charge. This is pretty common across most online tax preparation services, as a matter of fact, so it is a good thing to remember when you are budgeting for your taxes.

Can I upgrade my H&R Block online product if my taxes are more complicated?

Yes, you can usually upgrade your H&R Block online product if you find your tax situation is more complicated than you first thought. As you enter your information, the software will often tell you if you need to move to a higher-tier product to handle certain forms or situations. This flexibility is pretty helpful, so you are not stuck with a basic version if you need more features.

When it comes to figuring out "how much" you will pay for H&R Block's online tax services, it really boils down to your specific tax needs. The cost depends on the complexity of your financial life and the level of service you pick. So, take a moment to consider your income, your deductions, and any special situations you might have. This will help you choose the right online product and give you a clearer idea of your total tax preparation expenses for the year. It is all about making an informed choice, isn't it?

H&R Block Tax Software Review 2022: How To Easily File Taxes Online

H and R Block Review – no-frills tax accounting | Captain FI

.jpg)

5 useful tools when you file your taxes with H&R Block - Reviewed