Understanding The Innocent Spouse Form: Finding Relief From Unexpected Tax Bills

Finding yourself suddenly responsible for a tax bill you didn't create can feel incredibly unfair, can't it? Many people who filed taxes jointly with a spouse or former spouse sometimes discover unexpected tax debts. This situation, often a result of someone else's actions, can be very upsetting. Fortunately, there is a path to potential relief, a way for those who are truly free from legal guilt or fault to seek fairness. We are talking about the **Innocent spouse Form**, a critical tool for those who find themselves in such a difficult spot, as a matter of fact.

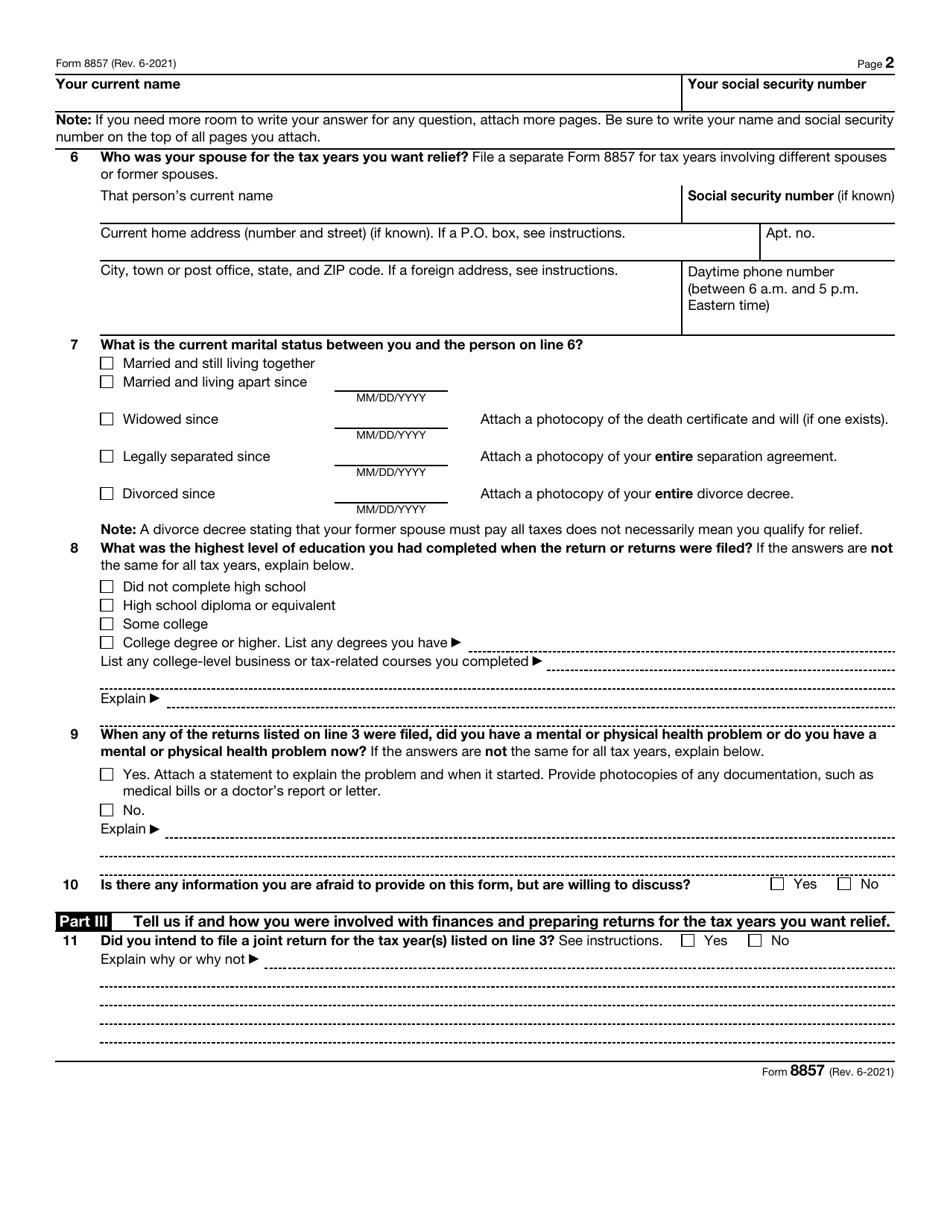

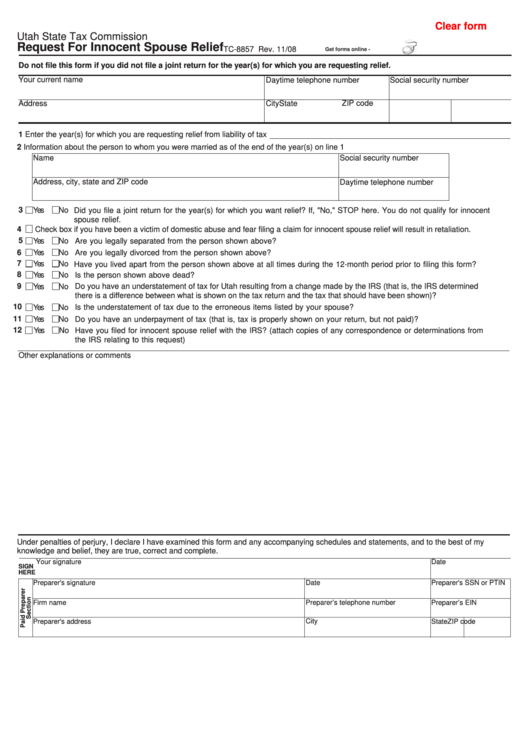

This special form, formally known as Form 8857, is there for people who might be held responsible for tax errors made by a spouse or former spouse on a joint tax return. It's about protecting individuals who, in essence, had no knowledge of the unpleasant financial issues or wrongdoing. It is a vital option for those who genuinely did not commit the error, so to speak.

If you are feeling overwhelmed by a tax notice that seems to come out of nowhere, especially if it relates to a joint return you signed, then learning about the Innocent spouse Form is a very good step. It could offer a way out of a financial bind that you really don't deserve, you know?

Table of Contents

- What Exactly is the Innocent Spouse Form?

- Who Might Need This Form?

- Different Kinds of Relief You Could Get

- How to Ask for Help: The Application Process

- What Happens After You Ask for Help?

- Important Things to Remember When Applying

- Common Questions About Innocent Spouse Relief

- Taking the Next Step Towards Relief

What Exactly is the Innocent Spouse Form?

The Innocent spouse Form, officially called Form 8857, is a request for Innocent Spouse Relief. It is a way for a person to ask the tax authorities for a break from paying tax, interest, and penalties related to a joint tax return. This applies when the tax is owed because of an error or omission made by their spouse or former spouse. It's for situations where you, the person asking for help, are truly not guilty of the particular financial mistake, you see.

This form is used when you believe it would be unfair to hold you responsible for a tax debt that came from your joint return. Perhaps your partner didn't report all their income, or maybe they claimed deductions that were not real. The form allows you to explain your situation and why you should not be held accountable. It is a rather important document for seeking fairness.

It is, in a way, a formal plea to the tax authorities. You are saying, "I signed this, but I had no knowledge of the problem, and I should not be punished for it." This process recognizes that sometimes, one person on a joint return might be unaware of their partner's dishonest actions, and should not be harmed because of them, naturally.

Who Might Need This Form?

This form is typically for people who filed a joint tax return with someone else, usually a spouse, and later find out there is an unpaid tax bill or a mistake on that return. The key here is that the mistake or unpaid tax was due to something their spouse did, or failed to do. This could be things like not reporting all income, claiming false deductions, or simply not paying the tax that was due. It is for situations where you feel you are not deserving to be harmed by someone else's actions, you know?

Perhaps you are now divorced, or maybe your spouse has passed away, and suddenly you receive a notice about a tax debt from years ago. Or maybe you are still married but were completely unaware of your spouse's financial dealings that led to the tax problem. In all these cases, the Innocent spouse Form could be your path to relief. It's about recognizing that you were, in a way, uncorrupted by the evil or wrongdoing that led to the tax issue, actually.

The process is not just for divorced people. It can apply to anyone who filed jointly and meets the other conditions. The main idea is that one person made the mistake, and the other person was truly innocent of that specific error. It's about proving you are free from guilt, sin, or immorality regarding the tax error, so.

Understanding "Innocence" in Tax Terms

When the tax authorities talk about "innocent" in this context, they are not just talking about being a good person. They are looking for specific conditions. You must show that you did not know, and had no reason to know, about the incorrect items on the tax return. This includes things like unreported income or incorrect deductions. It is about being truly free from legal guilt or fault concerning the tax issue, you see.

They will consider if it would be unfair to hold you responsible for the tax. This means looking at all the facts and circumstances. Did you benefit from the unreported income? Were you aware of the activities that led to the tax problem? These are the kinds of questions they will ask. The idea is to determine if you were truly "not guilty of a particular crime" in the tax sense, basically.

The tax authorities also look at whether you tried to hide anything or if you received a significant benefit from the errors. If you were truly unaware and did not benefit, then you are more likely to be considered "innocent" for tax purposes. It is about showing that you had no knowledge of the unpleasant and problematic financial situation, really.

Different Kinds of Relief You Could Get

When you fill out the Innocent spouse Form, you are actually asking for one of three types of relief. The tax authorities will look at your situation and decide which, if any, applies to you. Each kind has its own set of rules and requirements, and it's important to understand the differences. This helps you present your case in the best possible light, naturally.

Innocent Spouse Relief

This is the main type of relief people think of when they hear "Innocent spouse Form." To get this kind of help, you must meet several conditions. First, you must have filed a joint tax return. Second, there must be an understatement of tax on that return due to erroneous items from your spouse. An "erroneous item" means something like unreported income or an incorrect deduction. It is about a mistake that makes the tax bill lower than it should be, you know?

Third, when you signed the return, you must show that you did not know, and had no reason to know, about the understatement. This is a very important part. Fourth, it must be unfair to hold you responsible for the understatement, considering all the facts and circumstances. This means the tax authorities will look at things like whether you benefited from the error. This kind of relief is for when you are truly uncorrupted by the wrongdoing, so to speak.

For instance, if your spouse had a secret bank account where they hid income, and you had no way of knowing about it, that could be a strong case for innocent spouse relief. It is about proving that you are free from guilt, sin, or immorality regarding that specific tax mistake, you see.

Separation of Liability Relief

This type of relief is for people who are divorced, widowed, or legally separated, or who have not lived in the same household as their spouse for at least 12 months. With this relief, you might be able to divide the tax debt between you and your former spouse. This means you would only be responsible for your share of the tax, and your former spouse would be responsible for theirs. It is a way to separate the financial burden, in a way.

To qualify, you must show that you did not know about the incorrect items on the return when you signed it. However, even if you did know about some of them, you might still qualify for this relief for other items you didn't know about. This is different from innocent spouse relief where you must not have known about *any* of the erroneous items. This relief is for when you are not guilty of a crime or other wrong act, but still need to sort out shared responsibilities, naturally.

The tax authorities will also look at whether you transferred assets to avoid paying taxes. If you qualify, the tax liability is basically split up, and you are only on the hook for your part. It's about making sure you are not deserving to be harmed by the full amount when you only contributed to a portion, or none at all, actually.

Equitable Relief

Equitable relief is the broadest type of relief and can apply in situations where you do not qualify for innocent spouse relief or separation of liability relief. This can include cases where the tax was correctly reported on the return but not paid. For example, if you filed a joint return, and your spouse promised to pay the tax but never did, this might be an option. It is for when it would be simply unfair to hold you responsible for the tax, you know?

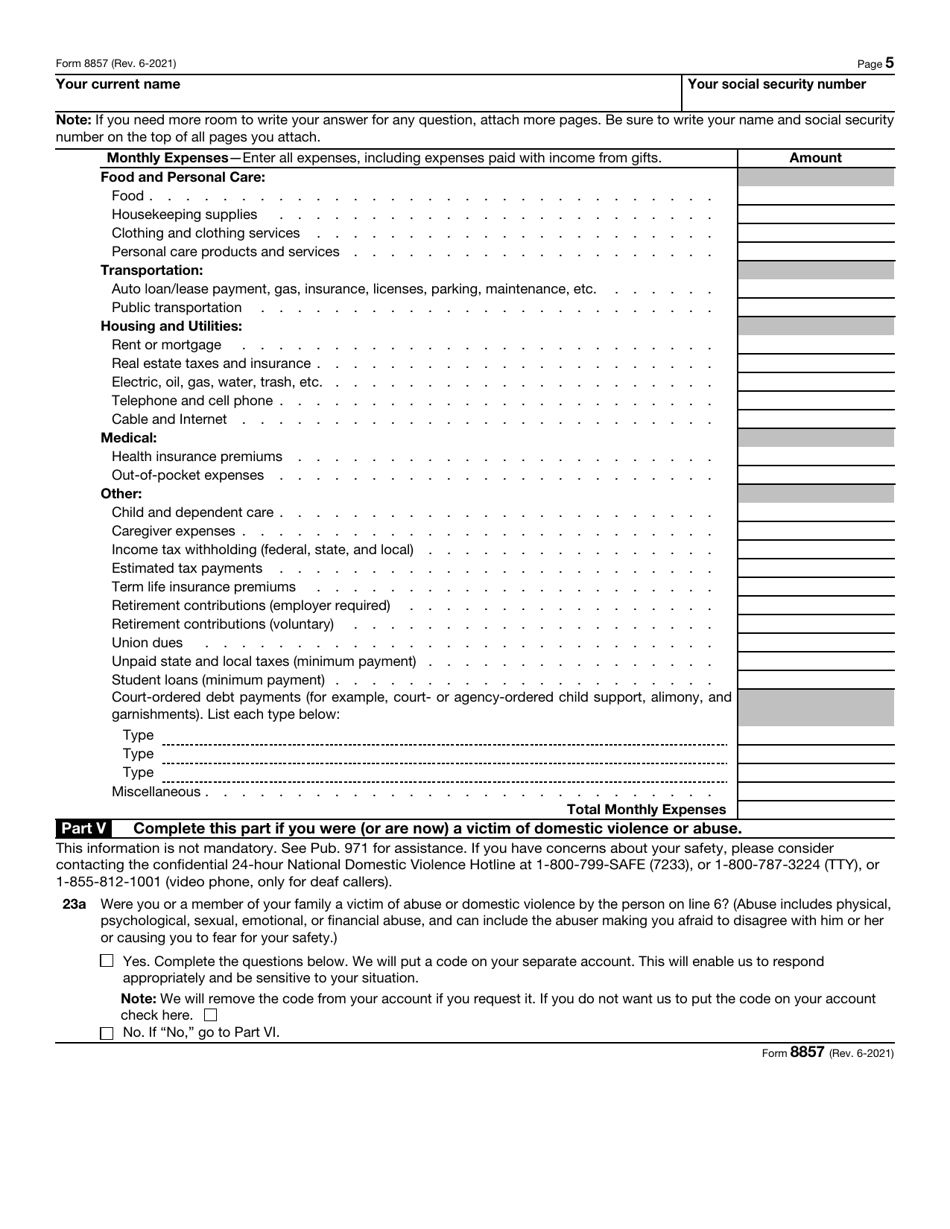

The tax authorities consider many factors when deciding if equitable relief is appropriate. They look at things like your current financial situation, your health, whether you were abused by your spouse, and if you received any benefit from the unpaid tax. They want to know if it would be a hardship for you to pay the tax. This relief is for when you are free from legal guilt or fault, but the other options just don't fit, so.

This relief is also used for situations where there might not be an "understatement" of tax, but simply an unpaid tax liability. It is a safety net for those who, through no fault of their own, are facing a tax burden that seems deeply unjust. It is about being uncorrupted by evil, malice, or wrongdoing, and seeking a fair outcome, really.

How to Ask for Help: The Application Process

To ask for any of these types of relief, you must fill out Form 8857, Request for Innocent Spouse Relief. This form asks for a lot of details about your situation, including why you believe you should not be held responsible for the tax. You will need to explain what happened, when it happened, and why you were unaware of the tax problem. It's a rather thorough process, you see.

You should gather all supporting documents you have. This includes things like divorce decrees, separation agreements, bank statements, and any communication with your former spouse about finances. The more evidence you can provide to support your claim of innocence, the better. This helps the tax authorities understand your full story and why you are not guilty of the particular crime, in a way.

It's important to file this form as soon as you can. Generally, you have two years from the date the tax authorities first try to collect the tax from you. This two-year rule is very strict, so do not delay. If you wait too long, you might lose your chance to get help, you know?

You can find the form and instructions on the official tax authority website. It's a good idea to read the instructions carefully before you start filling it out. They provide a lot of helpful information and explain what kind of details you need to include. Learn more about Innocent Spouse Form on our site, and link to this page for more tax help.

What Happens After You Ask for Help?

Once you send in your Innocent spouse Form, the tax authorities will review your request. This process can take some time, sometimes several months. They will likely contact your spouse or former spouse to get their side of the story. This is a standard part of the process, and it allows them to get a complete picture. They need to hear from both parties to make a fair decision, naturally.

During this time, they might ask you for more information or documents. It is very important to respond to these requests quickly and completely. If you do not provide the information they ask for, it could delay your case or even lead to your request being denied. Staying in touch and cooperative is key, you know?

After they have reviewed everything, they will send you a letter explaining their decision. If they grant you relief, they will tell you which type of relief you received and what it means for your tax bill. If they deny your request, they will explain why. You usually have the right to appeal their decision if you disagree with it, so.

Important Things to Remember When Applying

Applying for Innocent spouse Form relief is a serious matter, and there are a few things to keep in mind. First, be completely honest and provide all the facts. Any misleading information could harm your case. The tax authorities need to trust that you are telling them the full story, you see.

Second, gather as much evidence as you possibly can. This includes financial records, legal documents, and any communication that supports your claim. The more proof you have that you were unaware of the errors, the stronger your case will be. It is about showing you are free from legal guilt or fault, really.

Third, consider getting help from a tax professional. An experienced tax lawyer or enrolled agent can help you understand the rules, gather your documents, and present your case effectively. They can also help you if you need to appeal a decision. This can make a big difference in the outcome, you know?

Finally, remember that this process is designed to help people who are truly innocent of the tax errors. It is not a way to avoid paying taxes you rightfully owe. It is for those who are not deserving to be harmed by someone else's actions, actually. For more detailed information, you can always refer to the official IRS Form 8857 instructions.

Common Questions About Innocent Spouse Relief

What if my spouse refuses to cooperate with the IRS investigation?

If your spouse or former spouse does not cooperate, the tax authorities will still proceed with your Innocent spouse Form request based on the information they have. They will consider your statements and any evidence you provide. While their cooperation can be helpful, it is not always required for your case to move forward. The tax authorities understand that sometimes, getting cooperation can be difficult, you know?

Can I still get Innocent Spouse Relief if I knew about some of the errors?

If you knew about *some* of the errors, you might not qualify for the traditional Innocent Spouse Relief. However, you might still qualify for "Separation of Liability Relief" or "Equitable Relief." These other types of relief have different rules. For example, Separation of Liability Relief allows you to separate the tax debt even if you knew about some items, as long as you did not know about others. It is important to be honest about what you knew, and the tax authorities will consider which type of relief might fit your situation, basically.

How long does it take to get a decision on my Innocent Spouse Form?

The time it takes to get a decision can vary quite a lot. It often depends on the complexity of your case and the workload of the tax authorities. Some cases might be resolved in a few months, while others could take a year or even longer. It is a good idea to be patient and respond quickly to any requests for more information. They are trying to be very thorough, you see.

Taking the Next Step Towards Relief

Dealing with unexpected tax bills can be incredibly stressful, especially when you feel you are not responsible for them. The Innocent spouse Form is there to offer a way forward for those who are truly free from legal guilt or fault. It is a chance to explain your situation and seek the fairness you deserve. Taking the step to fill out Form 8857 can be a big relief, and it is a move towards putting these financial worries behind you, you know?

IRS Form 8857 Download Fillable PDF or Fill Online Request for Innocent Spouse Relief

Fillable Form Tc-8857 - Request For Innocent Spouse Relief printable pdf download

IRS Form 8857 Download Fillable PDF or Fill Online Request for Innocent Spouse Relief