Understanding The Downsides To Married Filing Separately For Your Taxes

Deciding how to file your taxes as a married couple can feel like a big puzzle, and sometimes, filing separately seems like it might be a good idea. However, it's pretty important to really get a handle on what that choice means for your money, because there are quite a few potential downsides that could end up costing you more. Many couples just assume it's a simple split, but the tax rules are a bit more involved than that, you know?

People often think about filing separately when one spouse has a lot of medical expenses, or perhaps a significant amount of student loan interest they want to deduct. Sometimes, too, it's almost about keeping finances a little more distinct, maybe for personal reasons or if there are past tax issues. But while those situations might seem to make separate filing look appealing, the tax code usually favors couples who file together, which is something many people overlook.

This article will walk you through the various ways that choosing to file separately could actually reduce your tax breaks and increase your overall tax bill. We'll explore the common pitfalls, from losing out on valuable credits to facing higher tax rates, so you can make a truly informed decision about your financial future. It's really about seeing the whole picture, you see.

Table of Contents

- Introduction to Married Filing Separately

- Lost Tax Credits and Deductions

- Higher Tax Rates and Standard Deductions

- Community Property States: Added Complexity

- Social Security Benefits Taxation

- Spousal Liability When One Itemizes

- Increased Administrative Burden

- Impact on Healthcare Subsidies

- Foreign Earned Income Exclusion

- When Married Filing Separately Might Make Sense

- Frequently Asked Questions

- Conclusion: Making Your Tax Choice

Introduction to Married Filing Separately

When you're married, the IRS gives you a couple of main ways to file your income taxes: either together, as "Married Filing Jointly," or separately, as "Married Filing Separately." Most couples, honestly, choose to file jointly because it usually results in a lower tax bill and offers more tax breaks. It's just how the system is set up, typically.

Filing separately means each spouse fills out their own tax form, reporting their own income, deductions, and credits. This sounds straightforward, but the rules change quite a bit when you choose this option. You lose access to many tax benefits that are only available to joint filers. So, while it might seem like a simple way to keep your money matters distinct, it often comes with a financial cost, you know, a bit of a trade-off.

Understanding these particular disadvantages is really important before you make a final decision. It's not just about what you gain, but what you might give up. For instance, some people think it helps with student loan repayment plans, which it can, but that benefit needs to be weighed against the tax impact. It's a balance, really.

Lost Tax Credits and Deductions

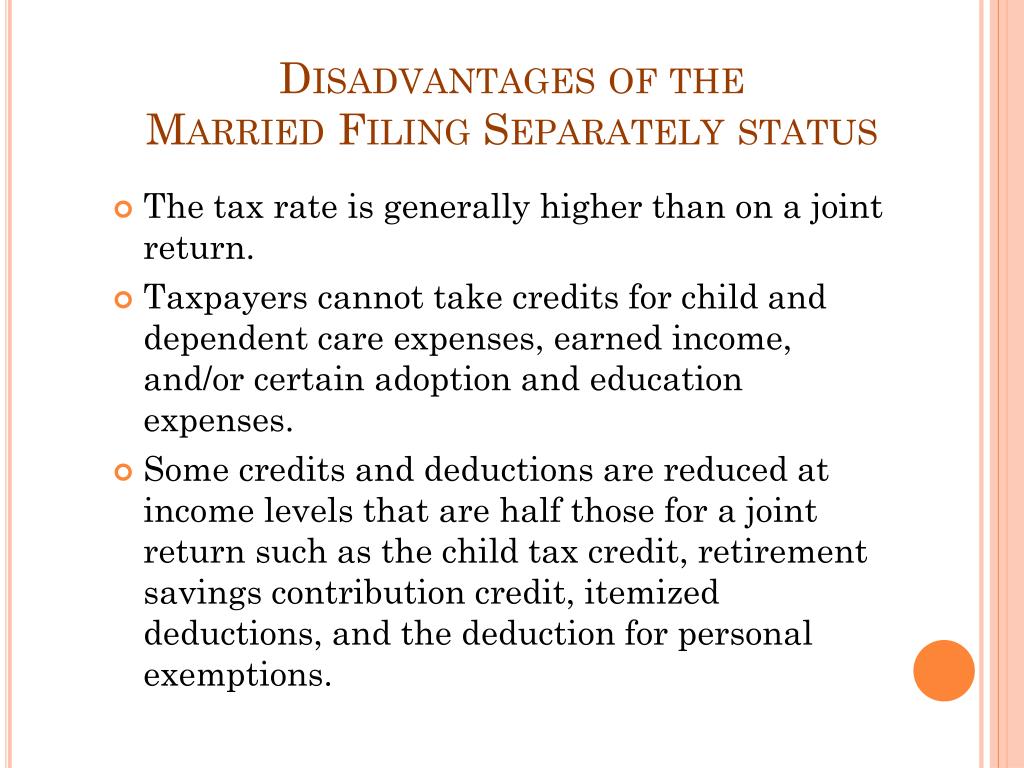

One of the biggest downsides to married filing separately is losing access to a whole bunch of valuable tax credits and deductions. These are things that can significantly lower the amount of tax you owe, or even get you a refund. When you file separately, the government basically says, "Nope, not for you," to many of these benefits. It's a pretty big deal for some families, actually.

For example, several common credits designed to help families and individuals are simply not available to those who file separately. This can include credits for low-income workers, those with children, or people paying for education. It's almost like you're choosing to leave money on the table, you know, potentially a lot of it.

Let's look at some of the specific credits and deductions that often disappear or become limited when you choose to file separately. This is where the financial impact really starts to show itself, so it's worth paying attention to these details, as a matter of fact.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit, or EITC, is a really important credit for low to moderate-income working people. It's designed to help boost their earnings and provide some financial support. However, if you're married and choose to file separately, you simply cannot claim this credit. It's completely off the table, you see.

This can be a significant loss for families who might otherwise qualify for a substantial amount of money back. For many, the EITC is a crucial part of their annual tax return, so giving it up just isn't a good idea. It's definitely something to think about very carefully, especially if your income is on the lower side.

Child and Dependent Care Credit

If you pay for childcare so you can work or look for work, the Child and Dependent Care Credit can help you recover some of those costs. But here's the catch: if you file separately, you're generally not allowed to claim this credit either. This means all those daycare or after-school program expenses won't give you a tax break, which is a bit of a bummer.

This particular restriction can hit families with young children or those caring for a disabled spouse or parent pretty hard. It's a credit that helps ease the financial burden of care, and losing it can really add up. So, if you have childcare costs, filing separately might not be the smartest move, honestly.

Education Credits

There are a couple of really helpful education credits out there, like the American Opportunity Tax Credit and the Lifetime Learning Credit. These are meant to help offset the costs of college or other higher education expenses. However, if you file separately, you usually can't claim either of these. It's a pretty big drawback for students or parents paying for school.

Imagine paying thousands for tuition and books, only to find you can't get any tax relief because of your filing status. That's a tough pill to swallow, you know? So, if you or your spouse are pursuing higher education, this is a definite reason to think twice about filing separately. It really is a significant benefit to miss out on.

Student Loan Interest Deduction

Many people have student loans, and the interest paid on those loans can often be deducted from your taxable income, which helps reduce what you owe. But, guess what? If you're married and file separately, you can't take this deduction. That means all that interest you're paying won't provide any tax relief, which is a shame, really.

This can be a big deal for couples who are still paying off significant student debt. Losing this deduction means more of your income is subject to tax, making those loan payments feel even heavier. So, if student loan interest is a factor for you, this is definitely a downside to consider, as a matter of fact.

IRA Contributions

While you can still contribute to an Individual Retirement Arrangement (IRA) when filing separately, your ability to deduct those contributions might be limited or even disappear entirely. This happens if you or your spouse are also covered by a retirement plan at work. The income limits for deducting IRA contributions are much lower for married individuals filing separately.

This means you might contribute to your retirement, but you won't get the immediate tax break you expected, which is a bit frustrating. It can impact your long-term financial planning and how much you save on taxes each year. So, if you rely on IRA deductions, this is a very important point to keep in mind.

Higher Tax Rates and Standard Deductions

Another major downside to married filing separately is that you often face higher tax rates and a smaller standard deduction. The tax brackets for married filing separately are typically less favorable than those for married filing jointly. This means more of your income gets taxed at higher percentages, which can really add up.

For example, the income thresholds for each tax bracket are generally half of what they are for joint filers. So, you hit those higher tax rates much faster. It's almost like the government is penalizing you for choosing to file apart, in a way. This alone can make a big difference in your overall tax bill, you know.

And then there's the standard deduction. When you file separately, each spouse gets a standard deduction that's half of what a married couple filing jointly would get. If one spouse itemizes deductions, the other spouse *must* itemize too, even if their itemized deductions are less than the standard deduction they would have received. This can be a pretty tricky rule and often leads to a higher tax liability for the couple combined, which is something to watch out for.

Community Property States: Added Complexity

If you live in a community property state, filing separately becomes even more complicated. In these states (like Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin), most income and assets acquired during the marriage are considered jointly owned, even if only one spouse earned the income. So, that's a thing.

When you file separately in a community property state, you generally have to split your combined community income and deductions right down the middle, 50/50, between both tax returns. This means you might be reporting income that your spouse actually earned, and vice versa. It can be a very confusing process, and honestly, it's easy to make mistakes.

This added layer of complexity often makes filing separately in these states more trouble than it's worth, unless there's a very specific and compelling reason to do so. It requires careful record-keeping and a good understanding of community property laws, which can be quite a lot to handle, you know.

Social Security Benefits Taxation

The way Social Security benefits are taxed can also be affected by your filing status. If you're married and file separately, you might find that a larger portion of your Social Security benefits becomes taxable. This is because the income thresholds for taxing these benefits are much lower for separate filers.

For example, if your combined income (including half of your Social Security benefits) exceeds a certain amount, up to 85% of your benefits could be taxed. For married individuals filing separately, this threshold is often zero, meaning your benefits might be taxed even if your income is relatively low. It's a pretty significant detail for retirees or those approaching retirement, actually.

So, if you or your spouse receive Social Security benefits, filing separately could lead to a surprising increase in your tax bill on that income. It's something many people don't consider until it's too late, so it's good to be aware of it now, as a matter of fact.

Spousal Liability When One Itemizes

This is a rule that can really trip people up. If one spouse chooses to itemize their deductions on their separate return, the other spouse *must* also itemize their deductions, even if their itemized deductions are less than the standard deduction they would have otherwise received. You can't mix and match; it's an all-or-nothing situation for the couple, you see.

Imagine one spouse has a lot of medical expenses or mortgage interest, making itemizing a good choice for them. But the other spouse has very few deductions. If they're forced to itemize, they might end up with a much smaller deduction than if they had taken the standard deduction. This can lead to a higher overall tax bill for the couple combined, which is a bit of a disadvantage.

This rule essentially ties your hands and can prevent you from getting the best tax outcome for both of you. It's a classic example of how filing separately can create unintended negative consequences, so it's very important to consider this before making a choice, you know.

Increased Administrative Burden

While not a direct financial cost, the administrative burden of filing separately can be a real pain. Instead of preparing one joint tax return, you now have to prepare two separate returns. This means gathering and organizing twice the paperwork, potentially dealing with more complex calculations, and ensuring everything is split correctly. It's just more work, really.

This can lead to more time spent on taxes, more stress, and potentially higher fees if you use a tax preparer. They'll likely charge more for two separate returns than for one joint return. So, even if the tax savings were minimal, the added hassle might not be worth it. It's something to think about, especially if you're not a fan of tax paperwork, which is pretty common.

Moreover, if you live in a community property state, as we discussed, the splitting of income and deductions can become incredibly complex, demanding even more attention to detail. It's honestly a lot to manage for many people, you know.

Impact on Healthcare Subsidies

If you or your spouse get health insurance through the Affordable Care Act (ACA) marketplace and receive premium tax credits (subsidies) to help pay for it, filing separately can really mess things up. Generally, if you're married, you're not eligible for these premium tax credits if you file separately. It's a pretty strict rule.

This means you could lose out on significant financial help with your health insurance premiums, making healthcare much more expensive. For many families, these subsidies are essential for making health coverage affordable. So, if you rely on them, filing separately is almost certainly not a good idea. It's a very practical concern for your budget, you see.

This particular downside can have a huge impact on your monthly expenses, far beyond just your tax bill. It's a real-world financial hit that needs careful consideration. Learn more about health insurance and tax implications on our site, as a matter of fact.

Foreign Earned Income Exclusion

For U.S. citizens or resident aliens living and working abroad, the Foreign Earned Income Exclusion allows them to exclude a certain amount of foreign income from their U.S. taxes. This is a pretty big benefit for expats. However, if you're married and choose to file separately, you might find that this exclusion becomes more complicated or less beneficial.

While each spouse can claim their own exclusion, the rules around how it interacts with other deductions and credits can get tricky. Sometimes, it just doesn't work out as favorably as filing jointly. So, if you're living abroad, this is another area where filing separately could lead to a higher tax burden or more administrative headaches, you know.

It's a specific scenario, but for those it affects, the implications can be quite substantial. Always check the latest IRS guidelines for foreign income, as they can be quite detailed. You can find more information about tax resources for expats by linking to this page.

When Married Filing Separately Might Make Sense

Despite all these downsides, there are a few very specific situations where filing separately could potentially be a better choice, or at least a necessary one. These are usually pretty rare and involve unique circumstances, you know. For instance, if one spouse has significant itemized deductions, like very high medical expenses, that would be reduced by the adjusted gross income (AGI) threshold if they filed jointly, filing separately might help that spouse claim more deductions. This is particularly true if the other spouse has a very low AGI.

Another common reason is if one spouse has unpaid taxes or other financial liabilities that they don't want the other spouse to be responsible for. Filing separately can help protect the "innocent" spouse from the tax debt of the other. Also, sometimes it's chosen for income-driven student loan repayment plans, where a lower individual income can lead to lower monthly payments. So, that's a thing.

However, even in these situations, it's really important to do a side-by-side comparison of the tax outcomes for both filing methods. You should honestly calculate your taxes both ways to see which one results in the lower overall tax bill for the couple combined. Often, the lost credits and higher rates still outweigh the benefits, which is pretty common. For detailed guidance, it's often wise to consult with a tax professional who can look at your specific situation. You can find more information on tax advice at a reliable source like the IRS website.

Frequently Asked Questions

Is it ever better to file separately?

Generally, it's pretty rare for married filing separately to result in a lower tax bill than married filing jointly. However, there are a few specific situations where it might make sense. This includes cases where one spouse has very high medical expenses or other itemized deductions that would be limited by a higher combined income if they filed jointly. Also, it might be considered if one spouse has serious tax issues or debts they don't want to affect the other. But honestly, it's not the usual path for saving money, you know.

Does married filing separately affect my spouse?

Yes, absolutely, it does affect your spouse. When one spouse chooses to file separately, it limits the tax benefits available to the other spouse as well. For example, if one spouse itemizes deductions, the other spouse must also itemize, even if their own itemized deductions are less than the standard deduction they could have taken. You also lose out on many credits that are only available to joint filers. So, it's a shared decision with shared consequences, really.

What tax credits are lost when filing separately?

Quite a few valuable tax credits are lost or significantly limited when you choose to file separately. These often include the Earned Income Tax Credit (EITC), the Child and Dependent Care Credit, education credits like the American Opportunity Tax Credit and Lifetime Learning Credit, and the deduction for student loan interest. You also generally can't claim premium tax credits for health insurance subsidies. It's a pretty long list of things you miss out on, you see.

Conclusion: Making Your Tax Choice

Choosing to file separately as a married couple, while sometimes seeming like a simpler or necessary option, carries a lot of potential downsides that can really impact your finances. From losing out on valuable tax credits and deductions to facing higher tax rates and added administrative burdens, the disadvantages are pretty significant for most people. It's a decision that needs careful thought, you know, not just a quick guess.

Before you commit to filing separately, it's truly important to weigh all these potential drawbacks against any perceived benefits for your specific situation. Consider running your taxes both ways, or even better, talk to a tax professional. They can help you understand the full picture and ensure you're making the choice that's best for your financial well-being, which is pretty smart, honestly. Your tax situation is unique, so getting personalized advice is often the best way to avoid unexpected costs.

PPT - Filing Status PowerPoint Presentation, free download - ID:6526682

Married filing separately – Artofit

:max_bytes(150000):strip_icc()/mfs.asp-final-92d6cd107fec480fa0bcbe2343401c9f.jpg)

Married Filing Separately Explained: How It Works and Its Benefits