What Happens If My Spouse Filed A Joint Tax Return Without My Consent?

Discovering your spouse filed a joint tax return without your permission can feel like a sudden, unwelcome shock. This situation, you know, can throw your financial world into a bit of a spin, leaving you with many questions about what comes next. It's a pretty serious matter, and understanding the potential fallout is the very first step toward getting things sorted out.

A joint tax return filed without your actual consent may not be legally valid, and that's a big deal. You might be wondering, quite naturally, how this affects your financial responsibility and, perhaps more importantly, the process for resolving such a tricky issue. It's a situation that, well, needs careful attention because the implications can be significant for your personal finances and your standing with tax authorities.

It is, in fact, illegal for an individual to file a joint tax return without the clear, expressed consent of their marital partner. If your spouse files a joint federal tax return without your consent, then that, quite simply, is considered fraud. Since it is fraud at a federal level, the penalties can be very severe, and they can affect both parties involved, even if one didn't know about it at the time. So, it's something you definitely need to address head-on.

Table of Contents

- Understanding Unauthorized Joint Filing

- The Serious Implications of Tax Fraud

- When Electronic Filing Becomes a Tax Crime

- How the IRS Handles Unauthorized Signature Cases

- The IRS's View on Consent and Proving Lack of It

- Joint Liability, Even After Divorce

- What If You Signed Without Reviewing?

- Court Precedents and the Validity of Returns

- Seeking Relief and Resolving the Issue

- Frequently Asked Questions

Understanding Unauthorized Joint Filing

When someone files a joint tax return, it usually means both spouses agree to the information presented and accept the shared responsibility for the taxes owed or refunds received. However, if your spouse files a joint tax return without your consent, that agreement is, well, just not there. This absence of consent makes the return's validity questionable from the start. It's not just a minor oversight; it's a fundamental breakdown of the legal requirements for a joint filing. So, in some respects, it's a very big deal.

The law is pretty clear on this point: both spouses must agree to file jointly. If one spouse signs the other's name without permission, it may be considered a forgery, which has its own set of serious legal ramifications. This act, too, goes beyond just a tax problem; it touches on issues of legal consent and, quite frankly, trust within a marriage. You see, it's not just about the numbers on the form.

The core issue here is consent. Without your explicit agreement, the very foundation of a joint return is missing. This can lead to a host of troubles, not just with the IRS but potentially with other legal bodies as well. It's something that needs to be addressed quickly, as a matter of fact, to protect your financial well-being and legal standing.

The Serious Implications of Tax Fraud

As mentioned, if your spouse files a joint federal tax return without your consent, that is considered fraud. This isn't just a simple mistake or an administrative error; it's a serious accusation with potentially severe consequences. Fraud, at a federal level, carries significant penalties that can include fines, interest charges, and even criminal charges. It's a very grave situation, to be honest, that demands immediate attention.

The IRS takes fraud very seriously, and they have processes in place to investigate such claims. If they decide that your spouse filed the return fraudulently, the repercussions can be far-reaching, affecting not just your spouse but also, potentially, you, even if you were unaware. This is why understanding your rights and options is so important. You know, it's about protecting yourself from something you didn't do.

The potential for severe penalties means you cannot simply ignore this issue. It requires proactive steps to inform the IRS and demonstrate that you did not consent to the filing. This is where getting proper guidance becomes absolutely essential, basically, to help you navigate a rather complex situation and avoid unintended negative outcomes for yourself.

When Electronic Filing Becomes a Tax Crime

In today's world, many tax returns are filed electronically. If your spouse filed it electronically themselves without your consent, then your spouse committed a tax crime. This is because electronic filing often requires a personal identification number (PIN) or other digital signature that implies consent. Using these without permission is a serious breach, a bit like signing someone's name on a physical document. It's a very clear violation.

The digital nature of the filing doesn't lessen the severity; in fact, it can sometimes make the act more traceable for authorities. The question might arise, too, about whether the refund was electronically deposited into a joint account or one solely controlled by your spouse. This detail can be very telling in an investigation, as a matter of fact, helping to show intent or how funds were handled.

A tax crime carries its own set of legal consequences, which can be distinct from civil penalties. These can include investigations by federal agencies and, if proven, can lead to criminal charges. It's a situation that, you know, can escalate quickly, so acting decisively is pretty important.

How the IRS Handles Unauthorized Signature Cases

It's important to understand that procedurally, unauthorized signature cases are not handled under the IRS innocent spouse rules. This is a common misconception, but the innocent spouse rules apply when a joint return was *validly* filed, but one spouse later discovers errors or omissions made by the other. In unauthorized signature cases, the primary goal is to convince the IRS that the return itself was never a legitimate joint return because consent was missing. So, it's a rather different path you take.

Rather, the goal is to convince the IRS to treat the return as if it was never a joint return at all. This means you are essentially trying to invalidate the joint filing from the outset, arguing that you should not be held responsible for any tax liability associated with it. This process can be quite involved, requiring you to present clear evidence that you did not provide consent. It's not always easy, but it's the correct approach for this particular situation, you know.

When one spouse neglects to actually sign the return, however, a host of troubles can ensue. Even if a physical signature is missing, the IRS might still assume consent if the return was filed and processed. This is why actively demonstrating a lack of consent is so important, especially if your name appears on a return you never approved. The authors detail the regulations surrounding this, highlighting the need for careful attention to detail. Basically, it's about proving your side of the story.

The IRS's View on Consent and Proving Lack of It

The IRS will generally assume that consent was given until or unless the complaining spouse can demonstrate that they did not consent to having the other sign their name or file jointly. This places the burden of proof squarely on your shoulders. You need to gather evidence that clearly shows you were unaware of the filing or actively objected to it. This might include emails, letters, witness statements, or any other documentation that supports your claim. It's quite a task, really, to put all that together.

Proving a lack of consent can be challenging, especially if there's no paper trail. The IRS wants clear and convincing evidence, not just a verbal assertion. This could involve showing that you were separated, living in different locations, or that your financial affairs were completely independent at the time of filing. The more evidence you have, the stronger your case will be. So, in a way, you're building a legal argument.

For example, in the case of Soni v. Commissioner, the Tax Court found that Anjali Soni, despite never signing the joint income tax return with her husband for the year in question, had still given implied consent. This was because she had previously filed jointly with him, knew about the income, and benefited from the refund. This case, you know, highlights just how complex proving a lack of consent can be and why every detail matters.

Joint Liability, Even After Divorce

If the IRS decides that your spouse filed the return without your consent, or even if they decide it was a valid joint return, the issue of joint liability is a critical one. This means the IRS can collect a joint liability from either you or your spouse, even after you’ve divorced, if you filed a joint federal income tax return. This can be a very distressing thought, particularly if you've moved on from the relationship.

The IRS can assert joint liability, meaning they can pursue either party for the full amount of tax, penalties, and interest owed on that joint return. This is true even if one spouse earned all the income or was responsible for the errors. This is why it's so important to address unauthorized filings immediately, as you could be held responsible for debts you didn't create or agree to. It's a pretty heavy burden, you know.

Understanding this joint liability is key to protecting yourself. It means that simply getting a divorce does not automatically sever your tax obligations from a previously filed joint return. You need to take specific steps with the IRS to resolve the unauthorized filing or seek relief from joint liability, even if the divorce is finalized. Learn more about tax relief options on our site.

What If You Signed Without Reviewing?

Sometimes, people sign tax returns without reviewing them at all, trusting their spouse to handle the details. Now that your spouse faces accusations of tax crimes or has already pledged guilty, you may worry that you are implicated. This is a common concern, and it's a bit of a tricky spot to be in. While signing without reviewing isn't ideal, it's different from your spouse forging your signature or filing without your knowledge. You know, there's a distinction there.

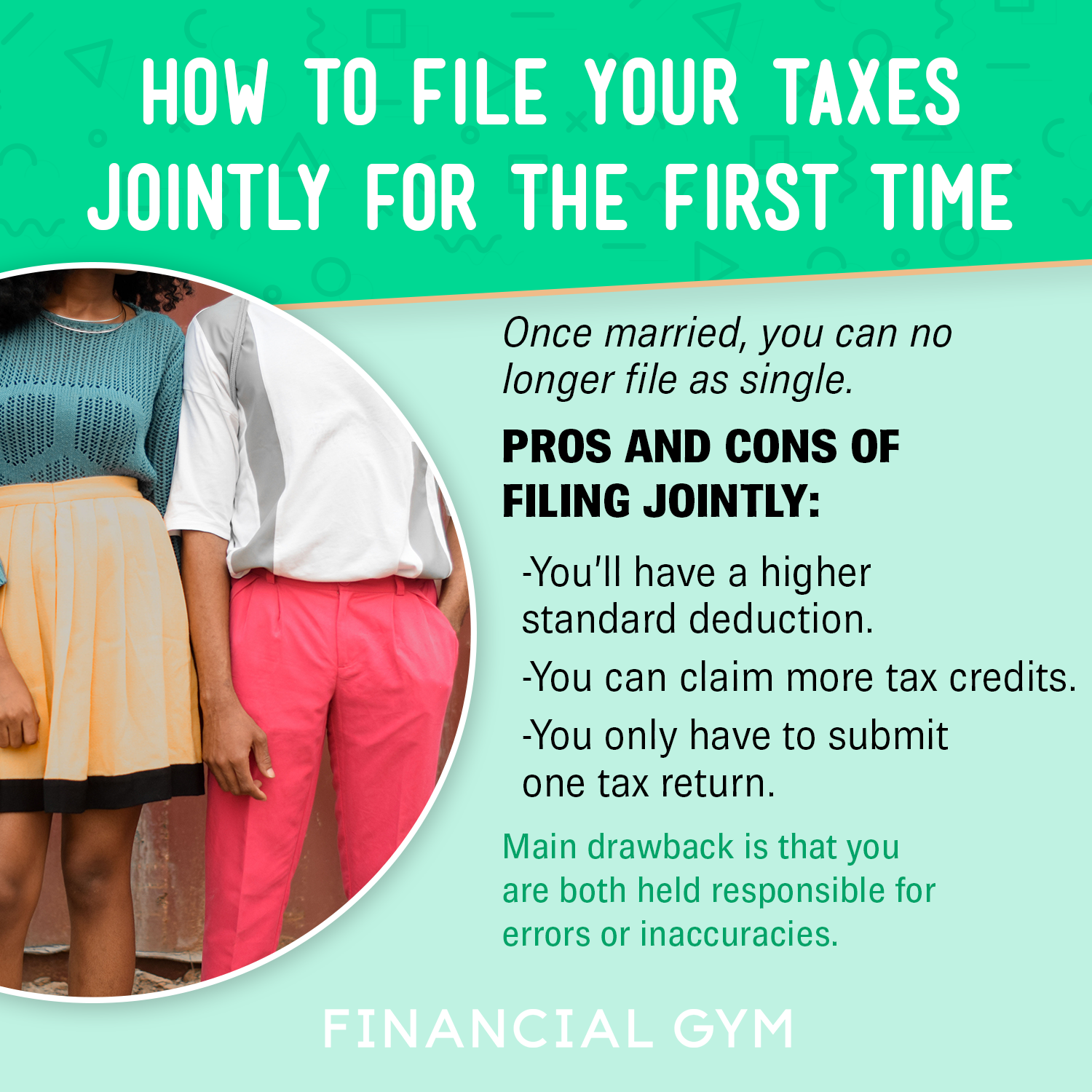

If you signed the return, even without looking at it closely, the IRS might argue that you implicitly consented to its contents. This makes your situation different from an unauthorized signature case. In such instances, you might need to explore options like innocent spouse relief, injured spouse relief, or other tax relief for spouses who owe extra taxes because of a joint tax return. These rules are designed for situations where a valid joint return was filed, but one spouse should not be held responsible for errors made by the other. It's a rather specific area of tax law.

It's important to remember that even if you signed, you still have rights and potential avenues for relief. The key is to demonstrate that you were unaware of the specific issues that led to the tax problems. This requires a careful review of the facts and, usually, professional guidance to present your case effectively to the IRS. So, you know, don't lose hope if you did sign something without fully understanding it.

Court Precedents and the Validity of Returns

The courts have, in some instances, taken a nuanced view on the validity of joint returns even when one spouse's signature was forged. A district court has held that, where a husband forged his wife's signature on their joint federal tax returns, the returns were still valid joint returns. The court said the wife had implicitly consented because she knew about the income and had benefited from the joint filing in some way. This particular ruling, you know, can seem a bit counterintuitive at first glance.

This shows that simply proving a forged signature might not be enough on its own. The IRS and the courts will often look at the broader context: Did the non-signing spouse know about the income? Did they benefit from the tax refund? Was there a history of filing jointly? These factors can influence whether the IRS considers the return valid, despite the lack of a direct signature. It's not always a black and white issue, really.

In the case of Soni v. Commissioner, [1] the Tax Court found that Anjali Soni, despite never signing the joint income tax return with her husband for the year in question, had implicitly consented. This was because she had knowledge of the income, benefited from the refund, and did not take steps to disavow the return when she became aware of it. This ruling underscores the importance of acting quickly and clearly stating your non-consent if you discover an unauthorized filing. It's a pretty strong reminder, actually, that inaction can be seen as agreement.

Seeking Relief and Resolving the Issue

If you find yourself in this difficult situation, finding information about innocent spouse relief, injured spouse relief, and other tax relief for spouses who owe extra taxes because of a joint tax return is a good start. While unauthorized signature cases aren't handled under innocent spouse rules directly, understanding these options can help you grasp the broader landscape of spousal tax relief. It's a bit like learning about all the tools in a toolbox, even if you only need one for a specific job.

The goal is to convince the IRS that you should not be held responsible for the tax liability. This usually involves filing a formal protest or petition with the IRS, explaining your situation and providing evidence of non-consent. This process can be complicated, and it often benefits from the guidance of a tax professional who understands IRS procedures. You know, someone who does this kind of thing all the time.

Acting quickly is key. The sooner you address the unauthorized filing, the better your chances of resolving the issue favorably. Ignoring it will only make things worse, potentially leading to collection actions against you for taxes you never agreed to. So, basically, don't delay. You can find more details on what to do next by visiting this helpful page on our site.

Frequently Asked Questions

Can I be held responsible for taxes if my spouse filed without my consent?

Yes, unfortunately, you could be held responsible. While a return filed without your consent may not be legally valid, the IRS might still try to collect from you, especially if they believe there was implied consent or if they can assert joint liability. It really depends on the specific facts of your case and how well you can demonstrate your lack of consent. So, it's not a simple "no," you know.

What kind of evidence do I need to prove I didn't consent?

To prove you didn't consent, you'll need strong evidence. This might include proof of separation at the time of filing, a history of separate financial accounts, documented communications where you expressed non-consent, or even police reports if forgery was involved. The more concrete evidence you have, the better your chances of convincing the IRS. It's a bit like building a legal case, actually.

What's the difference between "unauthorized signature" and "innocent spouse relief"?

The key difference is consent to file jointly. "Unauthorized signature" means you never agreed to file jointly in the first place, so the return itself might not be valid. "Innocent spouse relief," on the other hand, applies when you *did* consent to file a joint return, but later discovered errors or omissions made by your spouse, and you meet specific IRS criteria to be relieved of the tax liability. They are, you know, very different paths for very different situations.

[1] Soni v. Commissioner, T.C. Memo. 2017-195

Husband Compelled to File Joint Tax Return? | Divorce: New York

Form 1040 2023 Married Filing Jointly | Dependents Example Tax Filing

.png)

How to File Taxes Jointly for the First Time: Step-by-Step Guide for