What Is A 971 Notice From The IRS? Your Guide To Understanding This Important Mail

Getting mail from the Internal Revenue Service, the IRS, can feel a bit unsettling for many people, and that's completely understandable. When an envelope with that official return address shows up, you might find yourself wondering what it could possibly be about. One specific type of communication that sometimes arrives is an IRS Notice 971. This particular notice, while official, is often less about a problem and more about a change or an update to your tax account. So, it's pretty important to know what it means.

It's natural to feel a little bit of worry when you see any IRS correspondence, especially if you're not sure what it means. This kind of notice, the 971, has a specific purpose, and knowing that purpose can really help ease your mind. It's not usually a demand for more money, or a sign of an audit, which is something many people might initially fear. It actually tends to be more administrative in its nature, basically a heads-up about something the IRS has done on their end regarding your tax situation, and you know, that's good to understand.

To be clear, this IRS 971 notice is quite different from other things you might associate with the number "971." For instance, you might know "971" as an area code that serves places like Portland, Salem, and Hillsboro in Oregon, an overlay for the 503 area code, covering many cities and counties in the northwestern part of that state. Or, perhaps you recognize "971" as the country code for the United Arab Emirates, used when calling that nation from abroad. It's also the frequency for "97.1 The Ticket," a radio station many people listen to for sports and news. This IRS notice, however, is purely about your taxes and has nothing to do with those other uses, so it's a very specific kind of communication.

Table of Contents

- What Exactly Is an IRS 971 Notice?

- Why You Might Get a 971 Notice

- What to Do When a 971 Notice Arrives

- Understanding the Codes on Your Notice

- Frequently Asked Questions About the 971 Notice

- Keeping Your Tax Information in Order

What Exactly Is an IRS 971 Notice?

An IRS Notice 971 is a kind of notification from the tax agency that simply tells you they have made a change or an adjustment to your tax account. This change is often linked to another notice or action they've taken, so it's not usually a standalone issue. It often acts as a companion piece to other IRS mail you might receive, essentially confirming that something has been processed or altered on their side, and that's something to remember.

This notice is a general purpose communication that lets you know about various account actions. It could be about a refund being issued, a credit being applied, or even a correction to a prior tax return. It's basically a heads-up that a specific transaction or adjustment has been posted to your tax record. So, while it's an official piece of mail, it's often more informative than alarming, which is a bit of a relief for many.

Why You Might Get a 971 Notice

There are several reasons why the IRS might send you a 971 notice, and they are usually related to some sort of update or change in your tax situation. This notice almost always accompanies another action or notice, meaning it's not the first piece of mail about a new issue. It's more of a follow-up, confirming something that has happened or will happen with your tax account, and that's actually quite common.

Common Reasons for a 971 Notice

One common reason for receiving a 971 notice is when the IRS makes an adjustment to your tax return. This could be because of a mathematical error they found, or perhaps they received information from a third party, like an employer or a bank, that didn't quite match what you reported. They might correct your income, deductions, or credits, and this notice lets you know they've made that change. It's essentially their way of saying, "We've fixed something," or "We've updated your record," so that's a key point.

Another frequent situation involves credits or refunds. If you are due a refund, or if the IRS has applied a credit to your account, a 971 notice might accompany the refund check or a notice explaining the credit. This means the notice is actually good news, confirming that money is coming your way or that your tax burden has been reduced. It's basically a confirmation of a positive change, which is very helpful for people to see.

Sometimes, the IRS might also send a 971 notice if they need more information from you to process your return or to verify something. While the 971 itself doesn't usually ask for information directly, it might point to another notice that does. It could be part of a larger communication package where they are requesting details to finalize something on your account. So, it's a good idea to look for other notices that came with it, as that could be really important.

What the Notice Is Not

It's important to understand what a 971 notice typically is not. It's generally not a notice of an audit, or a direct demand for payment of additional taxes. While it might relate to an adjustment that results in more tax owed, the 971 itself is simply the notification that an action has been taken on your account. It's more about the administrative side of things, a confirmation of a change, rather than a new problem being introduced. So, it's pretty much a status update.

What to Do When a 971 Notice Arrives

When you receive an IRS 971 notice, the first thing to do is not to panic. This notice is a standard part of the IRS's communication process. Your immediate actions can help you understand the situation clearly and respond appropriately, if a response is even needed. It's basically about staying calm and organized, which is always good advice.

Steps to Take

First, carefully read the entire notice. Look for any other notices that might have come with it in the same envelope. The 971 notice often references other transaction codes or notices, so understanding the context is key. Pay attention to any numbers, dates, or specific instructions provided. Reading it all the way through is a very good starting point.

Next, compare the information on the notice with your own tax records. Does the change or adjustment mentioned make sense based on your tax return or any correspondence you've had with the IRS? If you've been expecting a refund or a credit, this notice might be the confirmation. Having your own documents handy can help you figure out what's going on, and that's really helpful.

Keep the notice for your records. Even if it seems like a simple confirmation, it's a part of your official tax history. If you have questions later, or if there's a discrepancy, having this notice can be very useful. It's generally a good practice to keep all IRS mail in a dedicated file, which can save you a lot of trouble down the line, so it's a good habit to form.

When to Act

In most cases, a 971 notice does not require you to take any immediate action. It's usually just an informational notice. However, if the 971 notice refers to another notice that does require a response, or if you disagree with the adjustment the IRS has made, then you will need to act. Always check for deadlines on any accompanying notices. If you need to respond, do so promptly and keep copies of everything you send, as that's pretty important.

If you're unsure about what the notice means, or if you believe there's an error, consider getting help. You can call the IRS using the number on the notice, but be prepared for potentially long wait times. Another option is to consult with a tax professional, like a Certified Public Accountant (CPA) or an Enrolled Agent (EA). They can help you understand the notice and advise you on the best course of action. They literally deal with these things all the time.

Understanding the Codes on Your Notice

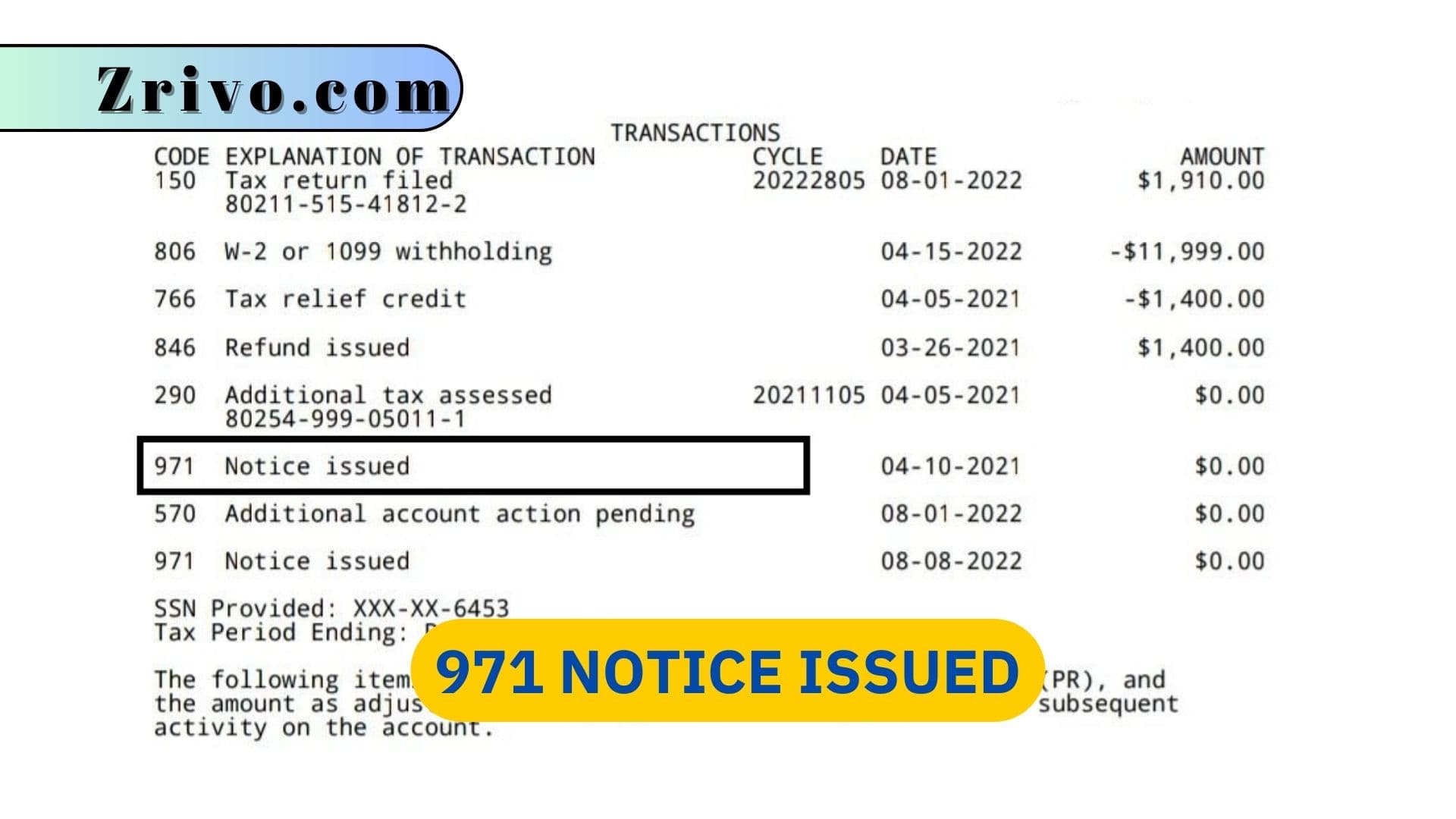

IRS notices often contain various codes that can seem like a secret language. The 971 notice itself is a "transaction code" that indicates a specific type of action has occurred on your account. You might also see other transaction codes on your tax transcript that relate to the 971. These codes provide more detail about the specific nature of the adjustment or action taken by the IRS. It's kind of like a shorthand for what happened.

For instance, a 971 code might appear alongside a 846 code, which means a refund has been issued. Or it could be with a 150 code, which indicates a tax return has been posted. Understanding these codes can give you a clearer picture of what the IRS has done. While you don't need to memorize them all, knowing that they exist and what they generally point to can be very helpful for interpreting your notice. So, it's pretty much about context.

Frequently Asked Questions About the 971 Notice

People often have similar questions when they receive this kind of mail from the IRS. It's a very common experience, and knowing what others ask can help you feel more prepared. Here are some of the questions that come up quite a bit, and we'll try to answer them simply.

What actions should I take after receiving a 971 notice? Generally, the 971 notice itself doesn't require action. Your main task is to read it carefully, along with any other notices it came with, to understand what change the IRS has made to your account. If another notice asks for a response or payment, then you need to follow those specific instructions. Basically, it's about being informed and ready to act if needed, so that's the key.

Is a 971 notice always a bad sign from the IRS? Not at all! In many cases, a 971 notice is simply an informational update. It could even be good news, like confirming a refund or a credit applied to your account. It's a procedural notice that tells you an action has been processed. So, it's not inherently a sign of trouble, which is a bit of a relief.

How long does it take for the IRS to process a change related to a 971 notice? The time it takes for the IRS to process changes can vary quite a lot. It depends on the complexity of the issue, the time of year (tax season is usually slower), and the current IRS workload. While the 971 notice confirms a change has been posted, the effects of that change, like a refund arriving, might take several weeks. It's pretty much a waiting game sometimes.

Keeping Your Tax Information in Order

Having a good system for your tax records is truly helpful, especially when you get mail from the IRS. Keeping copies of your tax returns, all supporting documents, and any correspondence from the IRS can make understanding notices like the 971 much easier. This kind of organization can save you time and stress if you ever need to clarify something with the tax agency. It's basically about being prepared, and that's always a good strategy.

Staying informed about your tax situation and understanding the various communications you might receive from the IRS is a very important part of managing your finances. While a 971 notice is usually nothing to worry about, knowing what it means can give you peace of mind. For more details on various IRS notices and tax topics, you can learn more about taxpayer rights and responsibilities on our site, and also find information on how to contact the IRS directly if you have specific questions about your account. Remember, being proactive with your tax information is always a smart move, so it's a good habit to keep.

Line 30 and Code 971 - Notice Issued : IRS

971 Notice Issued 2023 - 2024

Received Tax Code 971 notice? Here’s what you need to know. – Bloq Keeper