What Is The IRS Fresh Start Program? How It Helps With Tax Debt

Feeling overwhelmed by a pile of unpaid taxes can be a truly heavy burden, can't it? Many people find themselves in a tough spot with money they owe to the government, and it is a situation that brings a lot of worry. You might be wondering if there's any way out, any sort of help available to get things back on track. Well, there very much is a path forward for folks who are struggling with their tax obligations.

The good news, you see, is that the Internal Revenue Service, or IRS, understands that life can throw some curveballs. They know that sometimes, people just can't pay their tax bills all at once. That's why, in 2011, they introduced a really helpful initiative called the Fresh Start Program. This program, which has been around for quite a while now, is specifically put in place to give taxpayers a bit of a break and a chance to sort out their finances.

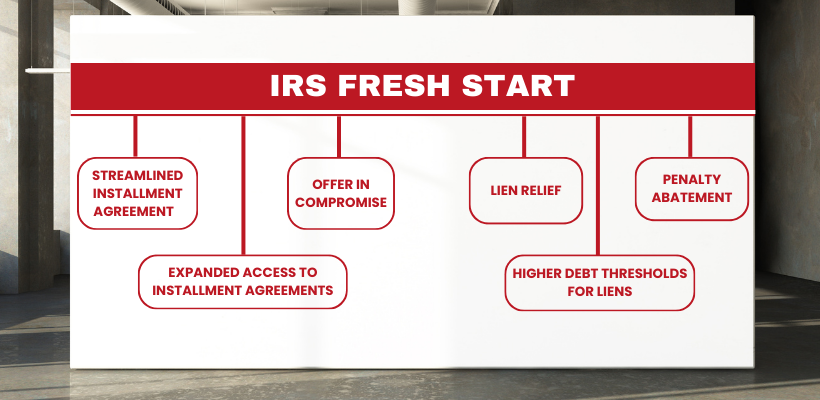

Basically, the Fresh Start Program is a collection of expanded tax relief policies. These policies make it much simpler for individuals and families who are having a hard time to pay back their taxes. It's designed, in a way, to help you avoid serious actions like your wages being taken or property liens, and it even gives some people the chance to settle their total tax amount for less than what they originally owed. It's a way to get a clean slate, so to speak, and get your tax situation straightened out, which is pretty amazing, really.

Table of Contents

- What is the IRS Fresh Start Program?

- Who Can Get Help from the Fresh Start Program?

- How the Fresh Start Program Eases Your Load

- What to Expect When the IRS Gets in Touch

- Other Ways to Deal with Tax Money Owed

- Getting Started with Your Fresh Start

- Frequently Asked Questions About the IRS Fresh Start Program

What is the IRS Fresh Start Program?

A Helping Hand for Taxpayers

The IRS Fresh Start Program is, quite simply, an effort by the Internal Revenue Service to lend a hand to taxpayers who are really struggling with taxes they haven't paid yet. It began back in 2011, and it's been a way for people to manage their tax situations when they feel like they're just drowning in what they owe. This program, you know, is all about giving people a second chance to get their finances straight with the government, which is a pretty big deal for many.

The Goal of a New Beginning

The main purpose of the Fresh Start Program is to give taxpayers a clear way to handle big tax bills that they just can't pay all at once. It's a set of expanded tax relief policies, actually, that make it much easier for folks who are having a tough time to pay back their taxes. This means it helps them steer clear of things like garnishments, where money is taken directly from their pay, and liens, which are claims against their property. It even allows some people to settle their total tax amount for less than what they originally owed, which can be a huge relief, honestly.

Who Can Get Help from the Fresh Start Program?

Meeting the Requirements

To be able to get help from the IRS Fresh Start Program, you do need to meet certain requirements. These are based on a few key things: how much money you make, what your history of filing tax returns looks like, and the total amount of tax money you owe the IRS. It's not a one-size-fits-all kind of thing, so the IRS looks at your unique situation to figure out if you fit the criteria. This is, you know, a pretty standard way for programs like this to work.

What the IRS Looks At

When you're trying to figure out if you can get help, the IRS will look at your financial picture. This includes your income, obviously, but also how consistently you've filed your tax returns in the past. They also consider the full amount of money you owe them. This program, you see, focuses on important issues such as your tax returns, the tax money you owe, and any collection letters you might have received. It offers eligible taxpayers different ways to pay what they owe so they can get a fresh start and regularize their tax obligations, which is a very thoughtful approach, really.

How the Fresh Start Program Eases Your Load

Avoiding Harsh Collection Actions

One of the biggest benefits of the Fresh Start Program is that it helps you avoid some of the more severe actions the IRS might take to collect money. We're talking about things like wage garnishments, where a part of your paycheck is taken directly to pay your taxes. It also helps you avoid tax liens, which are legal claims against your property, like your house or car, until your tax debt is paid. This program, you know, makes it simpler for people who are struggling to pay back their taxes, and that means less worry about these kinds of actions.

Options for Paying Your Money Owed

Depending on your particular situation, the Fresh Start Program offers several ways you might be able to pay off your tax money. The goal is to give you a way to manage those large tax bills you just can't pay all at once. This could involve setting up a payment plan that works for your budget, or in some cases, even settling your total tax amount for less than what you originally owed. It's about giving you payment choices to get a fresh start and get your tax obligations in order, which is pretty helpful, honestly, for many people.

What to Expect When the IRS Gets in Touch

How the IRS Contacts You

It's really important to know how the IRS actually contacts people about money owed. The IRS will not, ever, call you, send you a text message, or reach out through social media to demand an immediate tax payment. That's a very common scam tactic, so be aware. Instead, they always begin with a letter sent through the mail. This letter explains what they believe you owe and tells you how you can question or appeal what they've said. This is their official way of doing things, you know, and it's good to keep that in mind.

Your Right to Question Things

When you get a letter from the IRS, it's not the final word. The letter will explain how you can appeal or question what they've stated. You have the right to challenge their findings if you think there's a mistake or if you need to explain your situation. This is a key part of the process, and it allows you to communicate with them about your tax obligations. The IRS is always changing some of their policies, so it's always good to be up-to-date on how things work, which is something you can find out more about here on our site.

Other Ways to Deal with Tax Money Owed

Even if the Fresh Start Program isn't quite the right fit for your situation, there are still other ways to deal with money you owe the IRS. The IRS has different options available for people with delinquent tax debt, and it's worth exploring them. For example, you might be able to set up an installment agreement to pay off your taxes over time, or there might be other types of offers you can make to them. It's always a good idea to understand all your possibilities, and you can learn more about these kinds of situations by visiting this page.

Getting Started with Your Fresh Start

If you think the IRS Fresh Start Program might be right for you, the first step is usually to get in touch with the IRS. You can do this by calling their main number. When you call the IRS main number, you might find yourself navigating automated menus, but it is possible to talk to a live person. Some people find that if you don't press any prompts and just wait, you'll eventually be directed to someone who can help. They even have agents who speak Spanish to help you if you have questions about your tax situation, which is really helpful for many.

Before you call, it's a good idea to have all your information ready. This includes details about your income, your tax filing history, and the total amount of tax money you owe. Having everything organized will make the conversation much smoother and help the IRS agent understand your situation quickly. Remember, the goal is to find a way to manage those tax bills you can't pay all at once, and they are there to help you figure that out, which is pretty reassuring, really, for taxpayers.

For more official information on tax relief options directly from the source, you can always visit the official IRS website. This can be a very useful resource for understanding the different programs and getting reliable information about your tax obligations. It's always good to check official sources when dealing with something as important as your taxes, so that you are getting the most accurate and up-to-date details, which is just good practice, you know.

Frequently Asked Questions About the IRS Fresh Start Program

Is the IRS Fresh Start Program real?

Yes, the IRS Fresh Start Program is absolutely real. It was launched by the Internal Revenue Service back in 2011 as a genuine initiative to help taxpayers who are struggling with unpaid taxes. It's a collection of official tax relief policies, so it's not some kind of trick or scam. The program aims to make it easier for people to manage their tax money owed and avoid serious collection actions, which is a very real benefit for many, you know.

How long does the IRS Fresh Start Program last?

The IRS Fresh Start Program itself isn't a temporary thing; it's an ongoing initiative that the IRS has in place to help taxpayers. However, the specific relief options you might get through the program, like a payment plan or an Offer in Compromise, will have their own timeframes. For example, a payment plan might last for a set number of months until your tax money is paid off. So, while the program continues to exist, the duration of your specific relief depends on the arrangement you make with the IRS, which is pretty logical, really.

What happens if I don't qualify for Fresh Start?

If you find that you don't quite meet the requirements for the IRS Fresh Start Program, don't worry, you still have other possibilities for dealing with your tax money owed. The IRS has other options available for people with delinquent tax debt. These might include setting up an installment agreement, where you make monthly payments, or exploring other types of offers or agreements. It's worth talking to the IRS about your situation because they have various ways to help people get their tax obligations in order, which is a good thing to remember, actually.

What is the IRS Fresh Start Program - YouTube

Using the IRS Fresh Start Program for Tax Relief - Steven Klitzner

IRS Fresh Start Program - Here Is How To Qualify In 2025