How Much Does The CFO Of GEO Group Make? A Look At Executive Pay

Have you ever wondered about the financial details behind big companies, particularly what their top executives earn? It's a question many people ask, especially when considering a company like The GEO Group. Understanding how much a Chief Financial Officer (CFO) takes home can give you a pretty good idea about the company's financial health, its compensation practices, and even, you know, the broader trends in executive pay. This kind of information, arguably, sheds light on the significant responsibilities these roles carry and the financial structures that support large organizations.

For many, the idea of "how much" someone earns, especially a high-ranking executive, is a topic of considerable interest. What does "much" truly mean in this context? As my text suggests, the meaning of "much" is great in quantity, amount, extent, or degree. It signifies a large amount or to a large degree, even a far larger amount of something than one might want or need. In the world of executive compensation, "much" can mean a very substantial, important, or meaningful figure.

So, we're going to explore this very question for The GEO Group's CFO. We'll look at the different parts of their pay and where you can find this kind of information yourself. It’s important to remember that these figures aren't just a simple salary number; they are often a complex mix of various financial components, and that’s what we’ll be discussing, in a way.

Table of Contents

- Who Is The GEO Group's CFO?

- Personal Details and Bio Data of Brian R. Evans

- Understanding CFO Compensation: What Goes Into It?

- How to Find Executive Pay Information

- Factors Influencing CFO Pay at The GEO Group

- FAQ About CFO Compensation

- What Does "Much" Mean for Executive Pay?

- The Broader Picture of Executive Compensation

- Staying Informed About Executive Salaries

Who Is The GEO Group's CFO?

The Chief Financial Officer at The GEO Group is Brian R. Evans. He plays a pretty central part in the company's financial operations, overseeing everything from budgeting to financial reporting. His role is, you know, quite significant in making sure the company stays on a solid financial path and manages its resources effectively. He has been with the company for a good while, bringing a lot of experience to the table.

Personal Details and Bio Data of Brian R. Evans

Brian R. Evans has a long history with The GEO Group, which, basically, shows his deep familiarity with the company's operations and financial landscape. His career path reflects a steady climb through various financial roles, ultimately leading him to the top financial position. This kind of background is, in some respects, typical for someone holding such a senior executive role.

| Detail | Information |

|---|---|

| Name | Brian R. Evans |

| Current Role | Executive Vice President and Chief Financial Officer, The GEO Group, Inc. |

| Tenure as CFO | Appointed CFO in January 2009 (information may vary slightly based on the latest filings, but this is generally accurate as of recent public data). |

| Previous Roles | Prior to CFO, he held various financial management positions within The GEO Group, including Senior Vice President, Finance and Treasurer. |

| Education | Information typically found in proxy statements might include degrees and institutions, but specific details are not always highlighted publicly beyond official filings. |

Understanding CFO Compensation: What Goes Into It?

When we talk about how much a CFO like Brian R. Evans makes, it's really not just one number. It's a combination of different pay elements, each serving a specific purpose. These elements are designed to attract, keep, and motivate top financial talent, linking their pay to the company's performance. It’s pretty standard practice across many large companies, you know, to structure executive pay this way.

Base Salary

The base salary is the fixed part of a CFO's compensation, paid regularly, like every two weeks or monthly. It’s the steady income that provides a foundation for their overall pay. This amount is determined by things like the size of the company, the industry it's in, and the CFO's experience and responsibilities. For a company the size of The GEO Group, you can expect this base salary to be, well, quite substantial.

Annual Bonuses

Beyond the base salary, CFOs often get annual cash bonuses. These bonuses are usually tied to how well the company performs and how well the CFO meets specific goals. For instance, goals might include hitting certain financial targets, managing costs, or achieving specific strategic objectives. So, if the company does really well, the bonus can be, arguably, a very significant addition to their income.

Equity Awards (Stock Options and Restricted Stock)

A very large portion of a CFO's total compensation often comes from equity awards, which means shares in the company. This can be in the form of stock options or restricted stock units (RSUs). Stock options give the CFO the right to buy company stock at a set price in the future, while RSUs are shares given to them that they can’t sell until certain conditions are met, like staying with the company for a few years. This part of the pay package really links the CFO's financial interests to the long-term success of the company, and that's, like, a key idea behind it.

Other Benefits and Perks

In addition to the main components, CFOs also receive various other benefits and perks. These might include health insurance, retirement plans, deferred compensation, and sometimes things like company cars or allowances for travel and expenses. These benefits, you know, add to the overall value of their compensation package, even if they aren't direct cash payments.

How to Find Executive Pay Information

The great thing about publicly traded companies like The GEO Group is that they have to tell the public about their executive compensation. This information is available in documents filed with the U.S. Securities and Exchange Commission (SEC). The most important document for this is the annual proxy statement, also known as the DEF 14A. This document is sent to shareholders before the annual meeting and details executive pay, among other things. You can find these filings on the SEC's website, which is, honestly, a pretty straightforward process if you know where to look. For example, you can usually find these reports by searching the company name on the SEC EDGAR database.

By looking at these official documents, you can get the most accurate and up-to-date figures for Brian R. Evans's compensation for recent fiscal years. It’s important to check the most recent filings, as compensation figures can change quite a bit from year to year based on company performance and other factors. So, checking the latest reports is, well, always a good idea.

Factors Influencing CFO Pay at The GEO Group

A CFO's pay package, particularly for a company like The GEO Group, is shaped by many different things. One big factor is the company's overall financial performance. If the company does well, hitting its profit goals and managing its finances effectively, the CFO's bonus and equity awards are likely to be higher. This is, you know, pretty much how performance-based pay works.

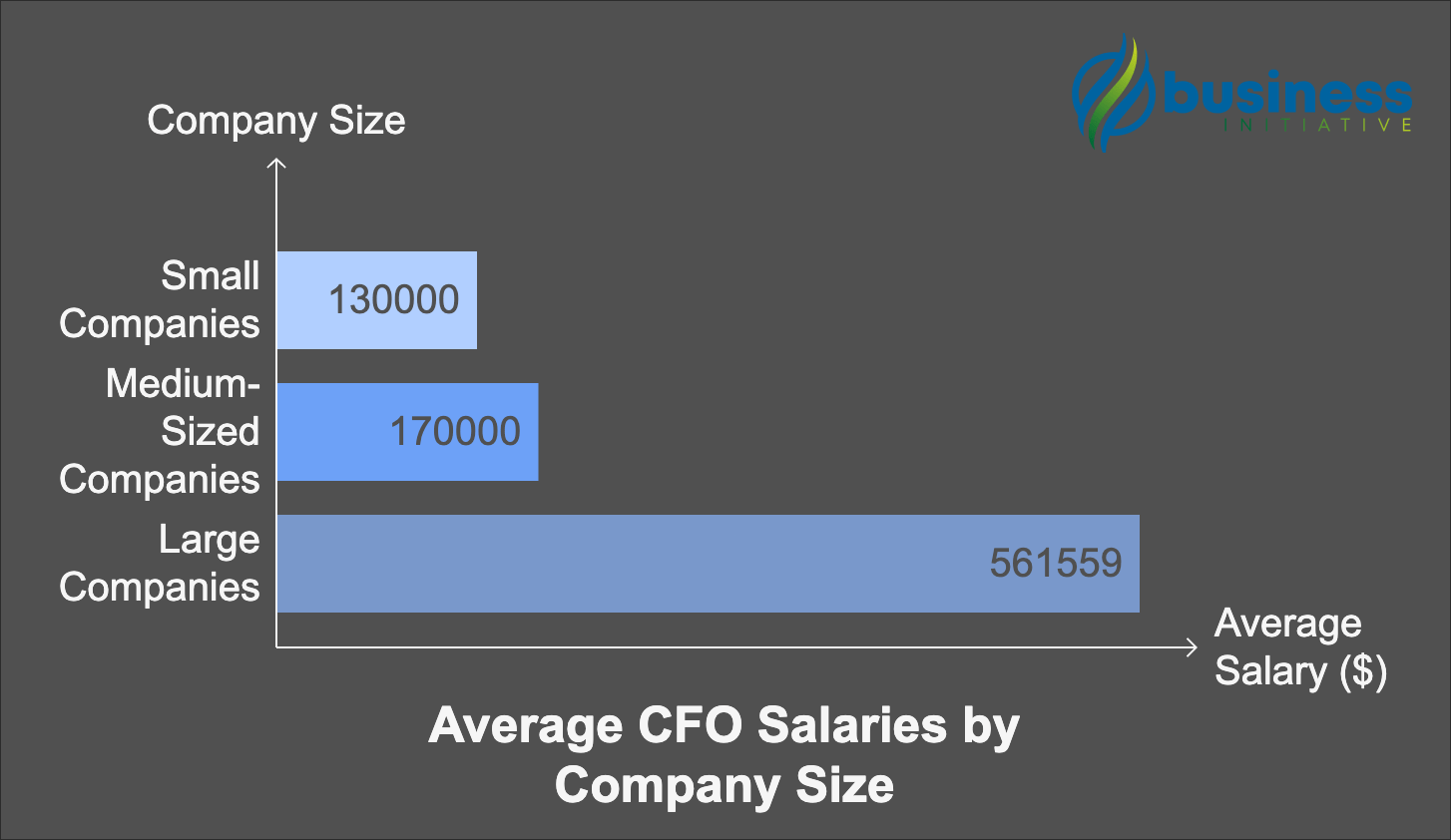

The size and complexity of The GEO Group's operations also play a role. As a large organization with diverse facilities and significant revenue, the CFO's responsibilities are extensive, which typically leads to higher compensation compared to a smaller company. The industry itself, which involves managing large-scale facilities and government contracts, can also influence pay levels. Furthermore, the CFO's individual experience, track record, and specific skills are, in fact, always taken into account when setting their pay.

FAQ About CFO Compensation

How is a CFO's total compensation calculated?

A CFO's total compensation is calculated by adding up their base salary, annual cash bonuses, the value of equity awards (like stock options and restricted stock units), and other benefits such as retirement contributions and perquisites. These components are, you know, all listed in the company's annual proxy statements.

Do CFO salaries vary significantly by industry?

Yes, CFO salaries can vary quite a bit across different industries. Industries with higher revenues, more complex financial structures, or greater regulatory scrutiny often offer higher compensation. The private corrections and detention industry, for instance, has its own unique financial challenges and scale, which can influence executive pay levels, so it's, like, a distinct area.

What are the primary sources for verifying a CFO's salary?

The primary and most reliable sources for verifying a CFO's salary are the company's annual proxy statements (DEF 14A filings) and annual reports (10-K filings) submitted to the U.S. Securities and Exchange Commission (SEC). These documents provide detailed breakdowns of executive compensation, and they are, actually, publicly available.

What Does "Much" Mean for Executive Pay?

When we ask "how much" the CFO of GEO Group makes, the word "much" here refers to a significant, important, or major amount, as my text points out. It’s about a large quantity or degree of compensation. For many, the figures involved in executive pay can seem like a "far larger amount of something than you want or need," especially when compared to average earnings. However, from a corporate perspective, this compensation is viewed as appropriate for the extensive responsibilities, strategic impact, and financial expertise required for such a high-level position. It’s a rather complex balance, you know, between public perception and corporate valuation.

The compensation is, in a way, a reflection of the market value for top financial leadership in a company of The GEO Group's scale and operational nature. It’s meant to attract and retain individuals who can navigate the company's financial landscape, manage risks, and contribute to its profitability. So, "much" in this context isn't just a number; it represents a substantial investment in leadership, and that's, honestly, a key point.

The Broader Picture of Executive Compensation

Looking at the CFO's pay at The GEO Group is just one piece of a much larger puzzle concerning executive compensation in general. These compensation packages are designed to align the interests of the executives with those of the shareholders. The idea is that if the company does well, the executives, especially through their equity awards, will also benefit financially. This alignment is, you know, a core principle behind modern executive pay structures.

However, executive compensation is also a frequent topic of public debate. People often discuss whether these pay levels are fair, especially in relation to the average worker's salary or the company's overall performance. This discussion often involves looking at how "much" is too much, or what constitutes a "meaningful" amount of compensation for the level of responsibility. It's a very active area of discussion, and it tends to be quite polarizing.

For those interested in corporate governance or finance careers, understanding these compensation structures is pretty important. It provides insights into how large companies operate financially and how they value their leadership. This kind of information can also be useful for investors who want to understand how a company manages its resources and rewards its top talent. You can learn more about executive compensation trends on our site, and you might also want to link to this page about corporate finance for more general information.

Staying Informed About Executive Salaries

Keeping up with executive salaries, like that of The GEO Group's CFO, means checking the latest public filings. Compensation figures are not static; they change each year based on company performance, market conditions, and individual agreements. For example, the compensation for Brian R. Evans for the fiscal year ending December 31, 2023, would be detailed in the proxy statement filed in the spring of 2024. So, to get the most accurate and current information, always refer to the most recent SEC filings. This approach ensures you are getting details directly from the company's official reports, which is, basically, the best way to stay informed.

Understanding "how much" a CFO makes goes beyond just the number; it involves understanding the various components of their pay, the reasons behind those amounts, and where to find reliable information. It’s a pretty good way to gain insight into the financial workings of large corporations, and it really shows the complexity of executive roles today.

Average CFO Salary Guide | Public & Private Company CFO Salary

Average CFO Salary by Company Size | How Much Does a CFO Make in 2025?

Average CFO Salary by Company Size | How Much Does a CFO Make in 2025?