What Is The Innocent Spouse Rule With The IRS? Getting Help With Tax Troubles

Finding yourself in a tough spot with the IRS, especially when it involves tax issues from a past relationship, can feel incredibly overwhelming. You might be looking at a tax bill that seems to have nothing to do with you, or perhaps you're just finding out about some money matters that were kept quiet. It's a situation that, frankly, nobody wants to be in, and it can bring on a lot of worry. Many people in this very position are seeking answers about something called the "innocent spouse rule" with the IRS, wondering if it could offer them a way out of a financial bind that isn't really their doing.

This rule, which is a part of tax law, is there for individuals who signed a joint tax return but later find themselves facing a tax problem that truly belongs to their former or current partner. It's about fairness, you see, making sure someone isn't held accountable for something they genuinely had no idea about. The idea behind it is pretty straightforward: if you were free from fault, if you truly had no knowledge of a problem, then you shouldn't have to carry the burden of someone else's mistake. It's a bit like being found not guilty of a particular crime, or being seen as someone who did not cause harm on purpose, which is very much what "innocent" means in everyday language.

So, we're going to talk about this important IRS provision, explaining what it is, who it might help, and what steps you can take if you believe it applies to your situation. This information aims to make things a bit clearer for you today, as you think about your next moves regarding tax obligations that feel unfair. We will look at how this rule can provide a path for relief when you are not deserving to be harmed by tax errors you didn't create or know about.

Table of Contents

- What Does "Innocent Spouse" Really Mean in Tax Talk?

- Why Does the IRS Have This Rule?

- Who Can Get This Kind of Help?

- Other Ways to Get Tax Relief

- How Do You Ask for This Relief?

- What Happens After You Apply?

- Things to Think About Before Applying

What Does "Innocent Spouse" Really Mean in Tax Talk?

When we talk about someone being "innocent" in everyday life, we often mean they are free from blame or guilt, perhaps even having no knowledge of the more unpleasant aspects of life. It can describe a person who did not commit a wrong act, or someone uncorrupted by evil. In the world of the IRS, the idea of an "innocent spouse" carries a very similar kind of meaning, though it's focused on money matters and tax forms. This rule is designed to give a break to a person who signed a joint tax return but, in truth, should not be held responsible for an error or a problem that showed up on that return. It's about recognizing that one person might have been completely unaware of an issue caused by their partner.

So, it's not about being innocent in a criminal sense, but rather, it's about being free from legal guilt or fault regarding a tax bill. For example, if your spouse or former spouse did not report all of their income, or if they claimed deductions that were not really allowed, and you had no idea this was happening, then you might be seen as an "innocent spouse." The rule is there to provide relief from the joint tax liability that comes with signing a shared return. It means you might not have to pay the extra tax, penalties, or interest that result from those mistakes. This can be a huge help, especially when you feel like you are not deserving to be harmed by something you had no part in.

The core idea is that you were genuinely unaware of the issue when you put your name on the tax document. It's about having no knowledge of the unpleasant parts of the tax return, or not causing harm on purpose. This provision helps ensure that someone who acted in good faith, and truly believed the tax information was correct, doesn't get stuck with a big bill because of someone else's dishonest actions or errors. It's a way for the tax system to offer a bit of fairness, which is pretty important, actually.

Why Does the IRS Have This Rule?

The IRS has this rule because, well, life can get complicated, and relationships sometimes end, leaving behind shared financial obligations. When two people are married, they often choose to file their taxes together, creating what's called a "joint tax return." The thing about a joint return is that both people who sign it are equally responsible for all the tax owed, even if one person earned all the money or caused all the mistakes. This is known as "joint and several liability." It means the IRS can come after either person for the full amount of tax due, which can be a real shock if you're suddenly facing a huge bill for something you didn't do or know about.

This rule, which has been around for a while, was put in place to address situations where this joint responsibility would be incredibly unfair. Imagine a scenario where one spouse secretly hides a lot of income, or makes up deductions that don't exist, and the other spouse has no clue about any of it. Without the innocent spouse rule, the person who was kept in the dark would still be on the hook for all those extra taxes, penalties, and interest. That would be, in a way, pretty unjust, wouldn't it? The rule helps prevent someone from being unfairly punished for a spouse's wrongdoing or significant error.

It's about providing a safety net for people who acted in good faith, who genuinely believed the information on their tax forms was accurate and complete. The government, through the IRS, recognizes that sometimes one person in a marriage might be in a position where they are not able to question the financial information, or they are simply unaware of what their partner is doing. So, this rule is a way to offer a path to freedom from the responsibility of having done wrong, allowing someone to move forward without the burden of someone else's tax problems. It's a provision that tries to add a measure of compassion to what can be a very rigid system, which is something many people appreciate.

Who Can Get This Kind of Help?

Getting help through the innocent spouse rule isn't something that applies to just anyone. The IRS has some specific requirements that you generally need to meet for them to consider you for this kind of relief. It's not a simple "I didn't know" and you're off the hook kind of thing; there are several factors they look at very carefully. Knowing these factors is, you know, pretty important if you think this rule might apply to your situation. Let's break down the main points the IRS considers.

Joint Tax Return Requirement

First off, to even be considered, you must have filed a joint tax return for the year in question. This rule is specifically for situations where two people shared the responsibility for a tax filing. If you filed separately, or as head of household, or single, then this particular type of relief won't be an option for you. It's all about that shared signature on the document, which made you both equally responsible for the tax bill, so that's a key starting point, actually.

Understatement of Tax

There has to be an "understatement of tax" on the joint return. What this means is that the amount of tax shown on the return was less than the amount that should have been reported. This usually happens because income was not fully reported, or because deductions, credits, or the basis of assets were claimed incorrectly. It's not about simply owing more tax than you expected; there has to be an actual error that led to a lower tax amount being stated on the original form. So, if you just made a calculation mistake, that's not what this is for.

No Knowledge or Reason to Know

This is, arguably, the most crucial part of being an "innocent spouse." You must show that when you signed the joint return, you did not know, and had no reason to know, that there was an understatement of tax. This means you were truly unaware of the incorrect items that led to the tax problem. The IRS will look at all the facts and circumstances here. Did you have access to the financial records? Did your spouse hide information from you? Was there anything that should have made you suspicious? For example, if your spouse suddenly bought a very expensive car that you knew they couldn't afford on their reported income, that might suggest you had a reason to know something was off. It's about your personal situation and what you could reasonably be expected to understand at the time, which is something they consider very, very carefully.

Unfair to Hold You Responsible

Even if you meet the other requirements, the IRS also has to agree that it would be unfair, or "inequitable," to hold you responsible for the understatement of tax. They consider a lot of different things here, like whether you received any benefit from the unpaid tax, if you were later divorced or separated, or if you were a victim of abuse. They also look at your current financial situation and whether paying the tax would cause you significant hardship. This part is about the overall fairness of the situation, making sure that you are not deserving to be harmed by the tax debt. It's a broad consideration, and it allows for a lot of individual circumstances to be taken into account, which is helpful.

Timely Request

You also need to ask for this relief within a certain timeframe. Generally, you have two years from the first time the IRS tries to collect the tax from you. This isn't two years from when you filed the return, but two years from when the IRS takes an "enforcement action," like sending you a notice of intent to levy or seizing a refund. It's really important to act quickly once you realize there's a problem and the IRS is coming after you. Missing this deadline can mean you lose your chance, so, you know, time is a bit of the essence here.

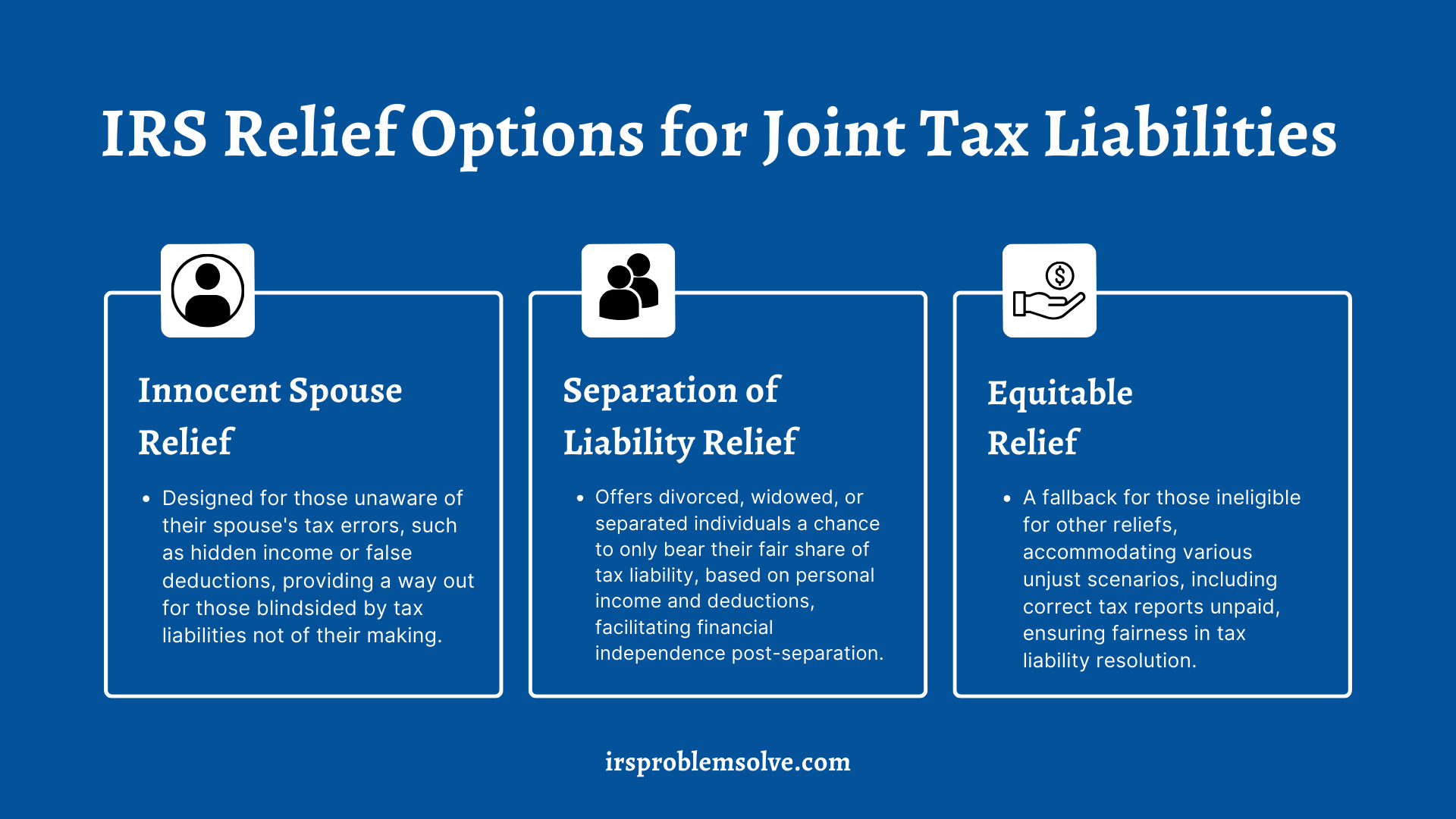

Other Ways to Get Tax Relief

While the innocent spouse rule is often the first thing people think about, it's actually one of three ways the IRS might grant relief from joint tax liability. If you don't quite fit the innocent spouse criteria, or if your situation is a bit different, there might still be other options available to you. It's good to know about these, as a matter of fact, because one of them might be a better fit for what you're dealing with.

Separation of Liability

This type of relief is for people who are divorced, legally separated, or have not lived with their spouse for at least 12 months before asking for relief. With separation of liability, the tax debt is divided between you and your former spouse based on who caused the error. So, if your spouse failed to report income they earned, that portion of the tax debt would be assigned to them. You would still be responsible for the part of the tax debt that relates to your own income or errors. This is different from innocent spouse relief, where you might be relieved of the entire amount of the understatement. To qualify, you generally can't have known about the error when you signed the return, and you can't have transferred assets to your spouse to avoid paying taxes. It offers a way to split things up, which can be pretty helpful.

Equitable Relief

Equitable relief is the broadest and, in a way, the most flexible type of relief. It's for situations where you don't qualify for innocent spouse relief or separation of liability, but it would still be unfair to hold you responsible for the tax. This can apply to understatements of tax, just like innocent spouse relief, but it can also apply to underpayments of tax. An underpayment happens when the tax was reported correctly on the return, but it just wasn't paid. The IRS considers many factors for equitable relief, including your current financial situation, whether you were abused, if you received a significant benefit from the unpaid tax, and whether you made a good faith effort to comply with tax laws. There isn't a strict two-year time limit for equitable relief, though it's still best to apply as soon as you can. It's a kind of catch-all category for when the other rules don't quite fit, but there's still a strong argument for fairness, you know.

How Do You Ask for This Relief?

If you think one of these relief options might be right for you, the way you ask the IRS for help is by filling out a specific form. This form is called Form 8857, Request for Innocent Spouse Relief. It's a pretty detailed form, and you'll need to provide a lot of information about your situation, including why you believe you qualify for relief. You'll need to explain what the understatement of tax was, why you didn't know about it, and why it would be unfair to hold you responsible. This is where you tell your story to the IRS, so it's important to be clear and thorough. You can find more details about this form and the process on the IRS website itself, which is a good place to start your research.

When you fill out Form 8857, you should also include any documents that support your claim. This could be divorce decrees, separation agreements, bank statements, emails, or anything else that helps show your lack of knowledge or the unfairness of your situation. The more evidence you can provide, the better your chances are. It's like building a case, in a way, where every piece of information helps paint a complete picture for the IRS. Make sure to keep copies of everything you send to them for your own records, which is always a smart move, basically.

You can send this form to the IRS by mail. The address is on the form's instructions. Remember the two-year time limit for innocent spouse and separation of liability relief, as we discussed earlier. For equitable relief, while there's more flexibility, applying sooner rather than later is generally a good idea. Taking this step is, like, the official way to get the IRS to look at your case and consider giving you a break from that tax debt.

What Happens After You Apply?

Once you send in your Form 8857, the IRS will begin to process your request. This isn't a super quick process, so patience is, you know, pretty important. The IRS will review all the information and documents you sent. They might also contact your spouse or former spouse to get their side of the story. This is a required step because it affects their tax liability too, so they have a right to be involved in the discussion. It's part of the process of getting all the facts straight.

After their review, the IRS will send you a preliminary determination letter. This letter will tell you whether they think you qualify for relief and, if so, under which type (innocent spouse, separation of liability, or equitable relief). If they decide you don't qualify, the letter will explain why. You'll have a chance to respond to this letter if you disagree with their findings or if you have more information to provide. It's a back-and-forth kind of communication, sometimes, until a final decision is reached.

If the IRS approves your request, they will adjust your tax account, and you will be relieved of the tax, penalties, and interest that they agree you are not responsible for. If they deny your request, or if you disagree with their decision, you have the right to appeal. You can take your case to the United States Tax Court, which is a place where you can challenge the IRS's decision. This is a more formal legal step, and it often involves getting help from a tax professional. So, the process can take a few twists and turns, but there are steps you can take at each stage, too.

Things to Think About Before Applying

Before you send off your Form 8857, there are a few things you should really consider. This process can be quite involved, and it might bring up some difficult memories or interactions, especially if you're dealing with a former spouse. First, gather all the financial records you can. The more organized and complete your information is, the better. This includes old tax returns, bank statements, pay stubs, and any documents related to your divorce or separation. Having everything ready will make the process smoother, which is always a good thing, right?

Also, think about whether you might need some professional help. Tax laws, especially those involving relief provisions, can be quite complex. A tax attorney or an enrolled agent who specializes in tax controversies can help you understand your options, prepare your case, and represent you before the IRS. They can also help you deal with any communication with your spouse or former spouse, which can be pretty stressful for some people. Getting good advice can make a big difference in the outcome, so it's something to seriously consider.

Finally, be prepared for the possibility that your spouse or former spouse will be contacted by the IRS. As mentioned, they have a right to know about your request because it affects their tax situation. This contact might lead to some difficult conversations or even disputes between you and them. Understanding this possibility beforehand can help you prepare emotionally and strategically. It's a big step to take, so knowing what's ahead is, like, really important. For more general tax information, you can always visit the official IRS website. Learn more about tax relief options on our site, and link to this page here.

IRS Innocent Spouse Relief - Pink Harbor, CPA

IRS Innocent Spouse Relief Frequently Asked Questions

What is IRS Innocent Spouse Relief? | Todd S. Unger Esq.